MSMEs play a pivotal role in catalysing economic growth through their multifaceted contributions. These enterprises, characterised by their agile size and diverse sectors, are engines of innovation, employment generation, and overall economic vitality. MSMEs foster entrepreneurship and create opportunities for local communities, aiding in poverty reduction and inclusive development.

By fostering innovation, they inject fresh ideas into the market, driving competitiveness and enhancing productivity. Moreover, MSMEs can absorb a substantial portion of the labour force, curbing unemployment and underemployment. Their decentralised nature ensures equitable distribution of economic benefits across regions, contributing to balanced regional development.

MSMEs are an essential part of our economy. Let us discuss the importance of SME finance, diverse SME banking options, and tips for managing finance for long-term success.

Importance of SME Finance

MSMEs are considered the backbone of economies due to their significant contributions, and providing them with proper finance is essential for their success and overall economic prosperity. Here’s why SME finance is of paramount importance:

- Job Creation: SMEs are substantial job creators, employing a significant portion of the workforce in many countries. Access to SME finance enables them to expand their operations, hire more employees, and contribute to reducing unemployment rates.

- Innovation: MSMEs are often at the forefront of invention, developing new products, services, and business models. Adequate financial support allows them to invest in research and development, fostering technological advancements and driving overall industry progress.

- Economic Growth: The growth of SMEs directly contributes to the economy’s growth as a whole. These enterprises generate increased economic activity, leading to higher GDP and improved living standards for citizens.

- Diversification: SMEs add diversity to the economic landscape by offering niche products and services that larger corporations might need to provide. This diversification strengthens the overall resilience of the economy and reduces its dependence on a few significant players.

- Regional Development: SMEs often operate in local or regional markets. Governments can promote more balanced economic development across different regions by supporting these businesses, especially in underdeveloped or rural areas.

- Supply Chain Growth: SMEs often serve as suppliers to larger corporations. Strengthening SMEs ensures a robust supply chain, reducing dependency on a few suppliers and enhancing overall business continuity.

Diverse SME Banking options

SMEs have a range of banking solutions tailored to their needs can be crucial for their growth and success. Here are some diverse SME banking options:

- Business Checking Accounts: These are essential for managing day-to-day transactions, payroll, and expenses. Look for accounts with low fees, online banking, and mobile app access for convenient management.

- Business Savings Accounts: These accounts help SMEs earn interest on surplus funds. Choose accounts with competitive interest rates and no or minimal fees.

- Business Loans: SMEs often need capital for expansion, equipment purchases, or working capital. Banks offer various loan options, such as term loans, lines of credit, and equipment financing.

- Business Credit Cards: Credit cards created for businesses are convenient for managing expenses, earning rewards, and building credit. Look for cards with rewards that align with your business needs.

- Merchant Services: If your SME accepts payments through credit and debit cards, having access to reliable and secure merchant services is essential. This includes point-of-sale (POS) systems and online payment gateways.

- Online Banking and Mobile Apps: User-friendly online banking solutions and mobile apps make it easy to manage your business finances on the go. Features may include fund transfers, bill payments, and account monitoring.

- Cash Management Services: These services help SMEs optimise cash flow, manage receivables and payables, and improve liquidity. Services may include account reconciliation, cash concentration, and automated sweeps.

- Foreign Exchange Services: If your SME engages in international trade, foreign exchange services can help you manage currency risk and facilitate cross-border transactions.

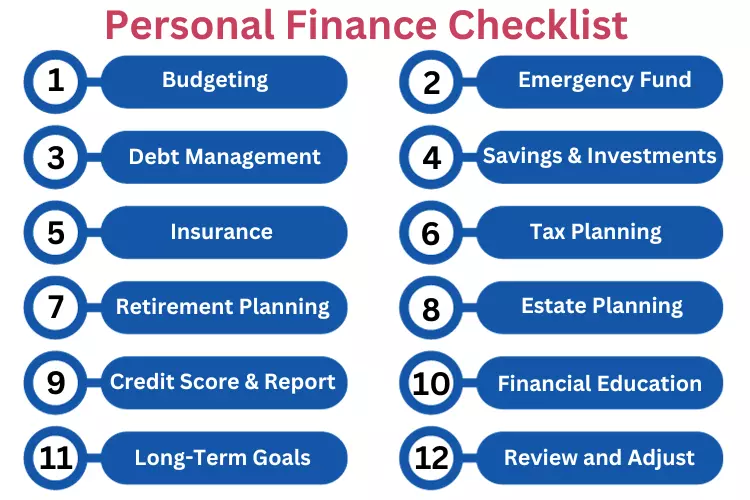

Tips for MSMEs to Manage Finance for Long-Term Success

Managing finances effectively is crucial for the long-term success of any Micro, Small, and Medium Enterprise (MSME). Here are some essential tips to help MSMEs navigate their financial management for sustained growth:

- Create a Detailed Budget: Develop a comprehensive budget that outlines your expected income and expenses. This will provide a clear overview of your financial situation and help you allocate resources wisely.

- Monitor Cash Flow: Regularly monitoring your incoming and outgoing funds is essential to stay on top of your finances. By doing so, you’ll be able to spot any potential cash shortages and make informed decisions to address them.

- Build an Emergency Fund: Establish a contingency fund to cover sudden expenses or periods of reduced income. A safety net ensures your operations can continue smoothly, even during challenging times.

- Separate Business and Personal Finances: You should keep your business and personal expenses in different bank accounts and maintain distinct financial records for each. This practice will facilitate accounting procedures and provide a more accurate assessment of your business performance.

- Invest in Accounting Software: Utilise user-friendly accounting software to streamline financial record-keeping, invoicing, and expense tracking. This will lower the risk of errors and save you valuable time.

- Manage Debt Wisely: If you need to borrow funds, do so judiciously and with a clear repayment plan. Avoid accumulating excessive debt that could strain your cash flow and hinder growth.

Final Thoughts

Fostering the growth of MSMEs through enhanced access to capital is paramount for economic progress and innovation. By offering a range of financing solutions tailored to the diverse needs of MSMEs, banks can empower these entities to reach their full potential, drive employment, and contribute to the overall development of our economy. As a steadfast supporter of MSMEs, HDFC Bank recognises the significance of facilitating access to capital and remains committed to providing comprehensive financial solutions that fuel growth. If you’re an MSME owner looking to expand your business horizons, we suggest you explore HDFC Bank’s diverse financing options. Connect with HDFC Bank today and unlock new avenues of success for your business.