Overview and Growth of Financial Industry of Bangladesh

The economy of Bangladesh is a mixed economy where both government and private sectors control the economy by planning and mixture of the market. In a broader sense, we can divide our economy into several industries. The financial industry is one of the leading industries which have great potentiality. Every year this industry is contributing a large amount of value to the GDP (Gross Domestic Product) of our country (Bangladesh).

With the expansion of the economy, we require to ensure the security of money and effective use of the money. Considering these needs financial institutions are formed. In our country both bank and non-bank financial institutions are available. Bank provides pure banking services and other financial services provided by non-bank financial institutions. Non-bank financial institutions can be financial intermediaries, insurance companies, and leasing companies.

Central Bank of Bangladesh (Bangladesh Bank) is the sole institution responsible for controlling the financial institution and financial industry. Under the control of Bangladesh bank, there are 65 banking institution (private, public/ state-owned, specialized, and foreign) and 32 nonbank financial institutions (mainly private) provides leasing and investment facilities and 62 insurance companies (private, public, foreign) providing life insurance and non-life insurance policies.

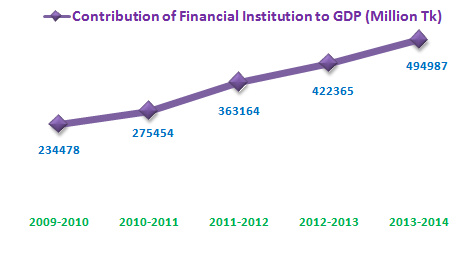

Contribution of Financial Institutions to our (Bangladesh) GDP

Every year millions of taka are contributed by these financial institutions and are expanding exponentially. For this reason, this industry considered a base industry for our country. If we see the trends of contributions made by this industry then it will be clear how much value-added. From the last 5 years of data, we can forecast that in the upcoming year our GDP will grow much more than these years.

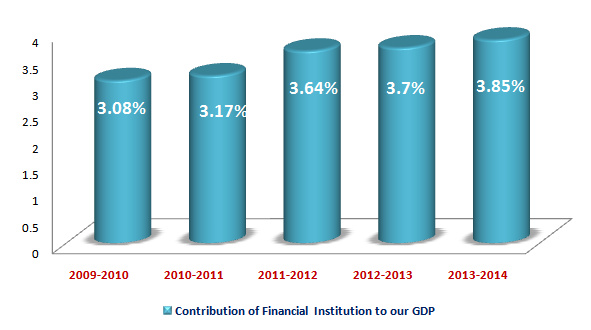

Percentage of Contribution to our GDP

People can say that only 3% plus contribution is not much for an economy. But I am strongly saying that this percentage looks small but the amount of contribution is huge. In 2009-10 the contribution was 3.08% but with the passes of time, this percentage is increasing. Last year that is 2013-2014 the contribution was 3.85%. Hope in the next year this will reach 4%.

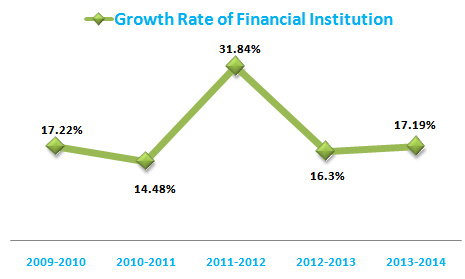

Growth of Financial Industry

Although this industry is doing well but with the change in the economic condition the growth also changes. There is a huge change in 2011-2012 in the financial sector according to the contribution to our GDP. Because of more foreign direct investment, there is an inflow of funds in the economy which circulate through financial institutions. Investment in long term assets and infrastructural development was done by the government and private sector. The positive sign is average growth is 15% plus. Near future hope, this will reach at 20% plus with the expansion of the total economy.

From the above identification, we can assume that one day our economy will be much more efficient. Because we have financial institutions with modern technology that providing services as required by the people at any time anywhere.

Written by

Md. Nahian Mahmud Shaikat

Student of MBA

Institute of Business Administration (IBA)

Jahangirnagar University

Email: [email protected]