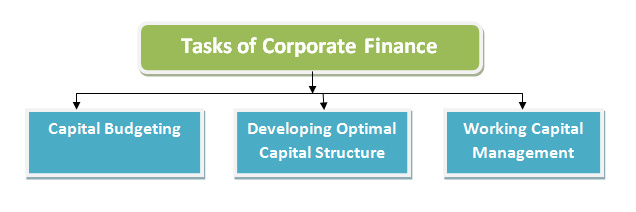

Corporate finance is a branch of finance where financing decisions about choosing a least-cost source of funds and optimal capital structure. The main tasks of corporate finance are to ensure the maximization of the value of the firm so that equity holders get the benefit. Remember one thing that corporate finance is not like public finance, both are different from each other.

The Main Tasks of Corporate Finance

- Capital Budgeting for the Corporation

- Forming Optimal Capital Structure and

- Management of Working Capital

Many people consider these tasks as a function of corporate finance. In addition to these tasks of corporate finance deals with many other financial activities according to the requirement of the corporation.

Capital Budgeting

Capital budgeting involves long-term investment decision making by analyzing investment alternatives. For long-term investment, a large amount of money is involved and the project manager has to spend lots of time and effort to execute the project. So before taking any long-term investment decision, it is required to make a capital budgeting. Popular forms of capital budgeting techniques are Net Present Value (NPV), Internal Rate of Return (IRR), Pay Back Period (PBP), Profitability Index (PI), and Modified Internal Rate of Return (MIRR).

It is corporate managers’ responsibility to ensure the right amount of investment in a project by evaluating investment alternatives by using capital budgeting.

Developing Optimal Capital Structure

Another important task that is followed in corporate finance is to develop an optimal capital structure for the corporation, which is choosing the right proportion of debt and equity capital. How much capital is to be raised by the debt and how much by equity fund is depends on the company’s financial strength and capability of using its resources. A company may choose fifty percent debt and fifty percent equity capital; 50:50, remember that it is not necessarily that every company uses 50:50 debt and equity, a company can choose 30:70 or 40:60, or 60:40, or 45:65 ratio of capital.

Management of Working Capital

Management of working capital is the process of managing the current asset and current liabilities for the company. A corporate finance manager will decide how will he/she ensure the right amount of current assets to pay off the current liabilities. Different option available to pay off current liabilities, it can be paid off from the current asset or from the long-term asset. Whether it is to be from the long term or short term is not a matter but the thing is the cost of pay off the current liabilities. Normal practice by the corporate financial manager is to pay off current liabilities by using a current asset. To ensure a good financial position it is required to have a good working capital management system.