Current Scenario of Denim Market of Bangladesh and SWOT Analysis

Worldwide denim product demand created the opportunity for the denim sector in Bangladesh. Here we will try to show what is the Current Scenario of Denim Market of Bangladesh and SWOT analysis and how our business opportunity is growing. According to managing director of Denim expert ltd., Currently Bangladesh has 31 denim mills with a capacity of 435 million yards of fabric a year. Bangladesh denim products beat European markets, the United States by occupying a lion’s share of denim. Bangladesh is one of the largest manufacturing and exporting countries of denim products in Europe with a 27% market share. With 14.20% market share, Bangladesh is the 3rd largest exporter of denim products in the US after Mexico and China. As per the Eurostat report, in 2017, Bangladesh exported denim products of €1.30 billion, in 2016 it was €1.29 billion; within a year rise of .54%. Bangladesh had an export growth of 9.55% in the US market at that year of $507.92 million. Pakistan, Turkey, and Vietnam are the three closest competitors of Bangladesh. Top products of denim from Bangladesh are, women/girl Blue Denim Trousers, man/boy Blue Denim Trousers, Blue Denim Skirts, man/boy Blue Denim Suit Type Coats, Playsuits or jumpsuits, shirts, etc. During an interview with Dhaka Tribune, general manager of Square Denim told that “Investment in denim fabrics and denim manufacturing has increased sharply. Because of this production capacity has increased too, pushing the export earnings up and taking the lead in the global markets”. During an interview with Dhaka Tribune, Abdus Salam Murshedy, Managing Director of Envoy Textiles which is the no one LEED platinum-certified green factory, told that “Buyers always want quality fabrics when it comes to denim products. For manufacturing a quality fabric it is necessary to use the latest technology and we have already established that.”

‘Technavio’ market research & advisory firm reported that the global denim market is worth $60 billion. It is expected to achieve a growth of annual 6.5% within 2020. As per their report, Asian countries will lead this sector & China is the fastest growing Asian country. During an interview with Dhaka Tribune, Managing Director of Denim Expert Limited quoted that, “There is hardly any adult in the world whose wardrobe does not contain at least one pair of jeans. Moreover, jeans are now worn and loved by women and children across the world because of its comfort, durability, and style. So, we must consider that there is a prospect of Bangladesh’s denim export in the coming years,” As Bangladesh is currently leading US & EU, there is a bright growth scope for this sector. He also added, “If Bangladesh can make its footing stronger in developing design and innovation, then the sky is the limit for our denim industry.” Bangladesh is moving to produce high demanding fashionable products rather than traditional wears. Denim or jeans products are more likely to choose by youngers, girls, students, labors who choose to be comfortable & trendy. As per Cotton Inc study report, among Europe and Latin American people 71% follow denim wears, 70% USA people choose to wear denim products, 57% Japanese & 58% Chinese people wear denim clothing. Bangladesh denim sector chooses to go green policy & producing in the environment-friendly method. This is another reason for attracting global buyers to business with us.

Top Foreign Denim Buyer of Bangladesh

| Brand name | Country |

| H & M | Sweden |

| Uniqlo | Japan |

| Tesco | UK |

| Walmart | USA |

| Levi’s | USA |

| Diesel | UAE |

| Wrangler | USA |

| G-Star | Netherland |

| s. Oliver | Germany |

| Hugo Boss | Germany |

| Gap | USA |

| PVH | USA |

| G-Star | Netherland |

| Charles Voegele | Italy |

| Jack and Jones | Denmark |

| River Island | UK |

| C&A | Belgium |

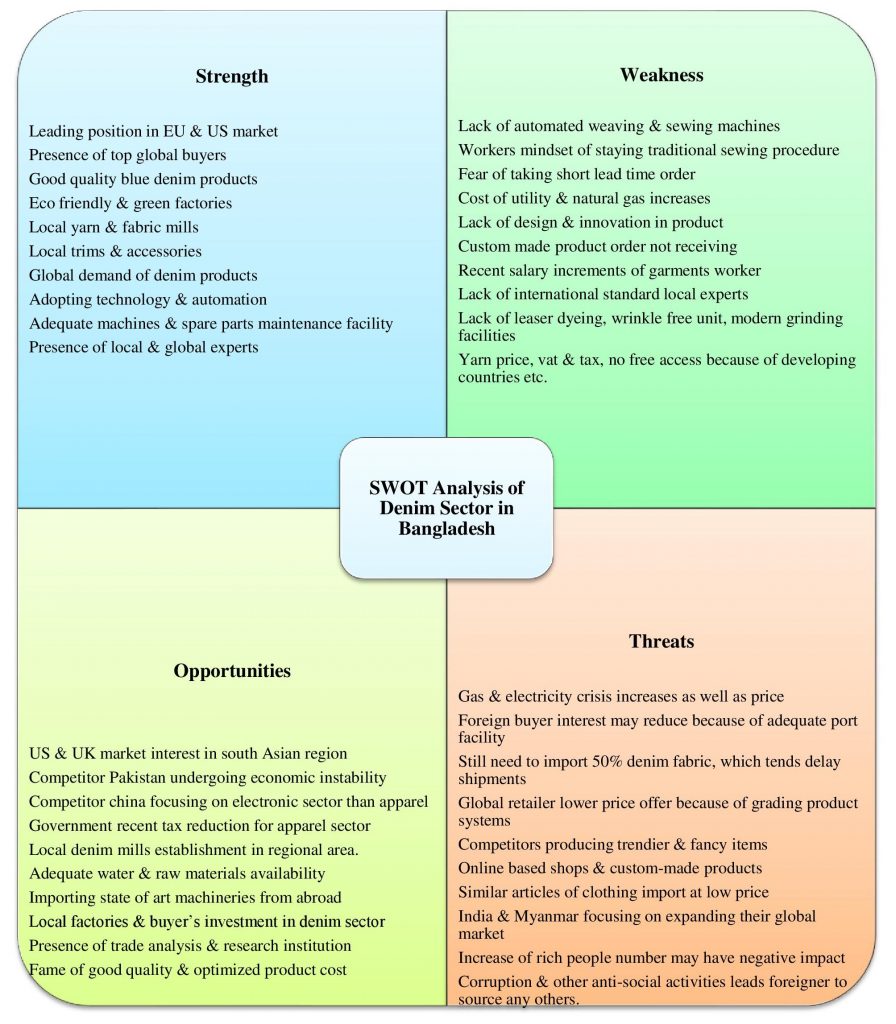

SWOT Analysis of Denim Sector of Bangladesh

Strength of Bangladesh Denim Industry

- Leading position in EU & US market

- Presence of top global buyers

- Good quality blue denim products

- Eco-friendly & green factories

- Local yarn & fabric mills

- Local trims & accessories

- Global demand for denim products

- Adopting technology & automation

- Adequate machines & spare parts maintenance facility

- Presence of local & global experts

Weakness of Bangladesh Denim Industry

- Lack of automated weaving & sewing machines

- Workers mindset of staying traditional sewing procedure

- Fear of taking short lead time order

- Cost of utility & natural gas increases

- Lack of design & innovation in product

- Custom made product order not receiving

- Recent salary increments of garments worker

- Lack of international standard local experts

- Lack of leaser dyeing, wrinkle-free unit, modern grinding facilities

- Yarn price, vat & tax, no free access because of developing countries etc.

Opportunities of Bangladesh Denim Industry:

- US & UK market interest in the South Asian region

- Competitor Pakistan undergoing economic instability

- Competitor China focusing on electronic sector than apparel

- Government recent tax reduction for the apparel sector

- Local denim mills establishment in the regional area.

- Adequate water &raw materials availability

- Importing state of art machinery from abroad

- Local factories & buyer’s investment in the denim sector

- Presence of trade analysis & research institution

- The fame of good quality & optimized product cost

Threats of Bangladesh Denim Industry

- Gas & electricity crisis increases as well as price

- Foreign buyer interest may reduce because of an adequate port facility

- Still need to import 50% denim fabric, which tends delay shipments

- Global retailer lower price offer because of grading product systems

- Competitors producing trendier & fancy items

- Online based shops & custom-made products

- Similar articles of clothing import at a low price

- India & Myanmar focusing on expanding their global market

- An increase in rich people number may have a negative impact

- Corruption & other anti-social activities lead foreigner to source any others.

Written by

Sharmin Akther Diba

Industrial & Production Engineer

Email: [email protected]

Linkedin: Sharmin Akther Diba