Difference between Systematic and Unsystematic Risk

As an investor, you must know the difference between systematic and unsystematic risk because it will help you to take an effective investment decision. If you observer the investment decision of an investor, you can see that their investment decision is highly influenced by their risk-taking behavior. Although the future is uncertain, people always try to assume how much risk may arise in the future if an investment is made.

A risk is the portion of uncertainty which we can measure. Normally risk is considered the deviation between what an investor expects and in return what he/she gets.

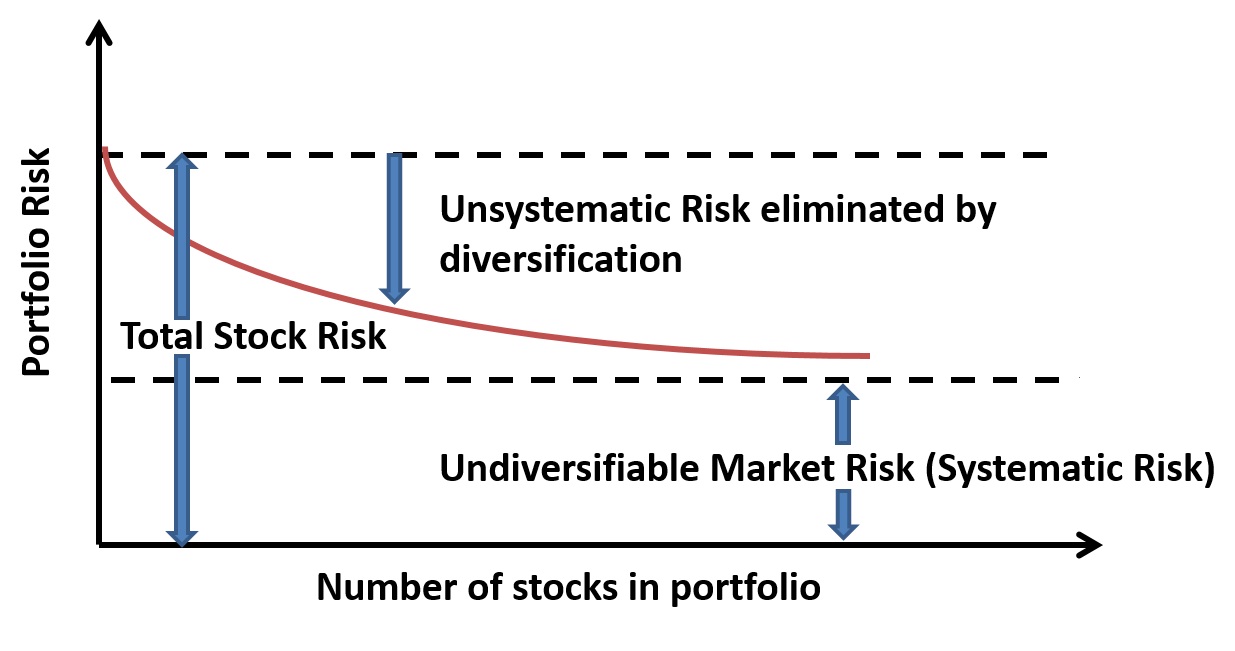

In a broader sense risk can be categorized into two types; one is a systematic risk which is a non-diversifiable risk and the other is an unsystematic risk or non-systematic risk or diversifiable risk. Let have a detail discussion of systematic risk and unsystematic risk with examples:

Systematic Risk

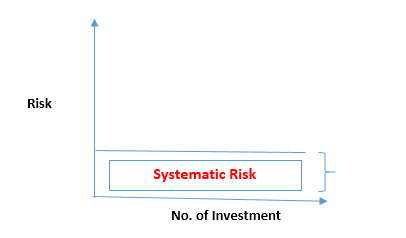

The percent of risk which we cannot minimize or reduce through diversification is considered as a systematic risk. This means that this type of risk is impossible to eliminate by an individual. It is directly related to the market, that’s why systematic risk also is known as market risk. From my point of view, the systematic risk arises from the macroeconomic factors (inflation, unemployment rate, oil price, etc.) which are beyond our control. Only through the proper economic planning of government can reduce these types of risks. One important thing you need to know that although implementation of effective economic policies by the government would reduce this type of risk it needs time to be visible in the market. That’s why we cannot consider it when taking our individual investment decisions.

Beta is the measure of systematic risk and market beta is always one. The reason behind market beta is to be 1 is that we cannot minimize or eliminate systematic risk on our own. Beta can be calculated by dividing the covariance between individual securities and market to the variance of the market.

Beta is the measure of systematic risk and market beta is always one. The reason behind market beta is to be 1 is that we cannot minimize or eliminate systematic risk on our own. Beta can be calculated by dividing the covariance between individual securities and market to the variance of the market.

Beta = Systematic Risk

Examples of Systematic Risk

As we have already known that systematic risk arises because of change in macroeconomic factors, for showing the example of systematic risk we will use macroeconomic factors (Inflation rate, unemployment rate, market interest, oil price, and political condition).

- Suppose the market interest rate is increased, in this case, if we want to borrow money from the market we have to pay more interest than previous because the cost of funds increased. Individually we cannot change the market interest rate so this works as a systematic risk.

- An increase in the inflation rate means the buying power of money is decreased. For this reason, we can buy fewer resources than previously. So an increase in inflation works as a systematic risk that existed in the market. The only monetary policy of the government can influence the inflation rate.

If there is an increase in the unemployment rate then people will have less money to purchase goods and services. And this will create a negative impact on the business which is beyond the control of individuals.

Unsystematic Risk

Unsystematic risk is also known as diversifiable risk or nonsystematic risk. This type of risk arises from the micro-economic factors which directly or indirectly related to business and through carefully managed you can eliminate this unsystematic risk.

A popular portfolio management concept is diversification, through investing in negatively correlated investment alternatives. That is investing in different companies from different industries that do not have any direct link between them. The better you manage your portfolio the lower will be your systematic risk.

As unsystematic risk is not directly related to the economic system, we can manage it in a better way through taking effective decisions individually and maximize our return on investment.

Examples of Unsystematic Risk

Individual industry or company-related to any kind of risk is considered as an unsystematic risk for the company. Examples of unsystematic risk can be:

- Increased labor turnover rate due to the dispute of payment related issues among employers and employees.

- Increase in research and development costs of the company.

- Increase in operational expenses.

Here in this graph, you can see that systematic risk is fixed in nature, that’s why we work on with unsystematic risk to eliminate it or keep it at a lower level. If it is possible then the total risk of the investment will be reduced.

List of Difference between Systematic and Unsystematic Risk

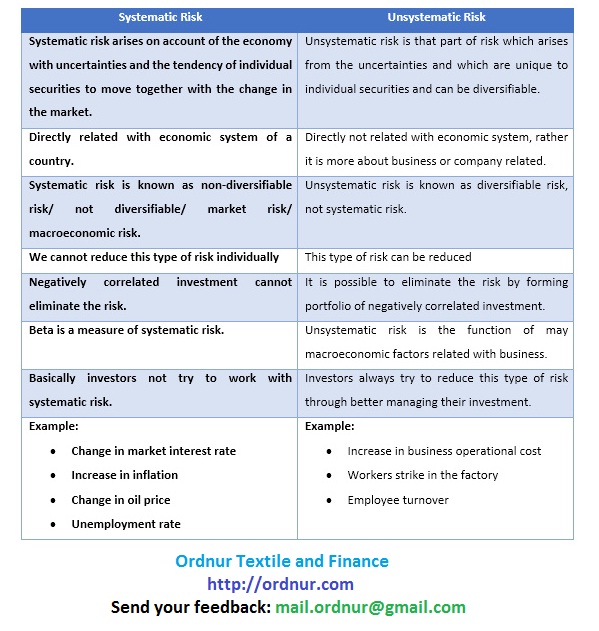

From the above clarification about systematic and unsystematic risk, we can easily identify much difference between systematic risk and unsystematic risk of the business/investment. Here is the list of difference between systematic and unsystematic risk:

|

Systematic Risk |

Unsystematic Risk |

|

Systematic risk arises on account of the economy with uncertainties and the tendency of individual securities to move together with the change in the market. |

Unsystematic risk is that part of risk which arises from the uncertainties and which are unique to individual securities and can be diversifiable. |

| Directly related to the economic system of a country. |

Directly not related to the economic system, rather it is more about business or company-related. |

|

Systematic risk is known as the non-diversifiable risk/ not diversifiable/ market risk/ macroeconomic risk. |

Unsystematic risk is known as diversifiable risk, not a systematic risk. |

| We cannot reduce this type of risk individually | This type of risk can be reduced |

| Negatively correlated investment cannot eliminate the risk. |

It is possible to eliminate the risk by forming a portfolio of negatively correlated investments. |

| Beta is a measure of systematic risk. |

Unsystematic risk is the function of may macroeconomic factors related to business. |

| Basically, investors not try to work with systematic risk. |

Investors always try to reduce this type of risk by better managing their investment. |

Examples:

|

Examples:

|

Although we cannot work with the systematic risk we have many things to do with unsystematic risk because if we can manage it in a better way, then our business will be more profitable with lower risk. By choosing negatively related investment alternatives we can form an optimal portfolio but it is not an easy task for the financial manager. There is the involvement of risk with every investment alternatives but we have to consider the systematic portion and then work with controllable factors which we actually can improve.

Finally, my suggestion is for you that takes time for risk analysis before any investment, otherwise, you may have to incur a loss. Risk always was there and will be there, so do not afraid to take the challenge, think, and then take the right choice.

Finally, my suggestion is for you that takes time for risk analysis before any investment, otherwise, you may have to incur a loss. Risk always was there and will be there, so do not afraid to take the challenge, think, and then take the right choice.