In the dynamic world of commodities, mentha oil and crude oil hold distinct yet increasingly interconnected positions. While crude oil dominates as a global benchmark for energy prices, mentha oil plays a critical role in India’s agro-based industries, especially in the FMCG and pharmaceutical sectors. In times of market volatility, understanding how the option chains of these two commodities behave can provide valuable insights to investors, hedgers, and policymakers alike.

This article dives deep into comparing the crude oil option chain with that of mentha oil, especially during volatile periods. We’ll also explore the role of market indicators like copper MCX live prices and how they influence or correlate with the behavior of these option chains.

Understanding the Basics

What Is an Option Chain?

An option chain is a listing of all available option contracts for a particular asset, usually sorted by expiration date and strike price. It displays crucial information such as:

- Call and Put prices

- Open interest

- Volume traded

- Implied volatility (IV)

Analyzing an option chain helps in understanding market sentiment, price direction expectations, and hedging strategies.

Mentha Oil Rate Today: The Agricultural Commodity in Focus

Mentha oil, extracted from the mint plant, is largely produced in India, especially in Uttar Pradesh. The mentha oil rate today is influenced by a range of factors:

- Climatic conditions impacting yield

- Export demand, especially from China and Europe

- Domestic demand from FMCG sectors (toothpaste, balm, cosmetics)

- Government regulations on stock limits

Volatile weather and shifting policies often lead to rapid price fluctuations, making mentha oil option chains an important tool for farmers and investors to manage risk.

Crude Oil Option Chain: The Global Volatility Benchmark

Crude oil, on the other hand, is influenced by:

- OPEC+ production decisions

- Geopolitical tensions in oil-rich regions

- Global economic indicators like GDP, interest rates, and inflation

- Currency fluctuations (especially USD)

Because of its global nature, the crude oil option chain reflects broader economic fears and optimism. Open interest and implied volatility can spike due to conflicts, sanctions, or major policy shifts.

Copper MCX Live: A Silent Influencer

You may wonder what copper mcx live prices have to do with mentha or crude oil. Interestingly, copper is considered a leading indicator of industrial demand. Rising copper prices usually signal economic expansion, which could mean higher demand for both crude oil and mentha-based products. During times of volatility:

- A spike in copper prices may lead to increased energy consumption (higher crude oil demand).

- Strong industrial activity may boost mentha demand from manufacturers.

Thus, copper MCX live data is a useful supplementary signal when analyzing both mentha oil rate today and crude oil option chain behavior.

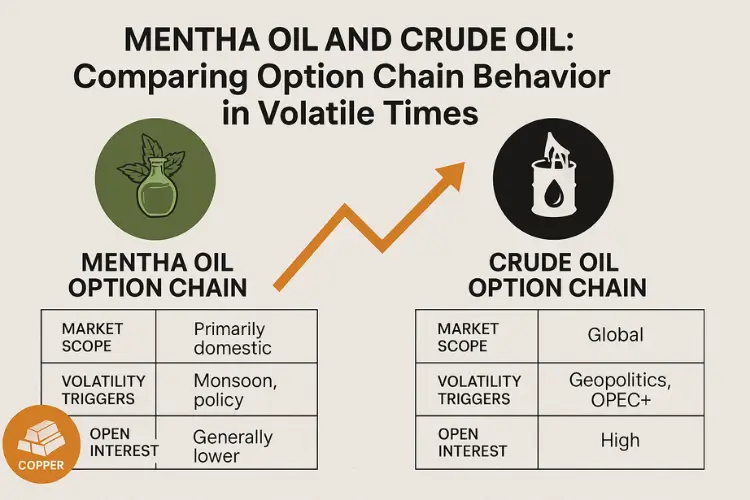

Comparative Table: Mentha Oil vs Crude Oil Option Chains

| Parameter | Mentha Oil Option Chain | Crude Oil Option Chain |

| Market Scope | Primarily domestic (India-focused) | Global |

| Volatility Triggers | Monsoon, govt policy, domestic demand | Geopolitics, OPEC+, global demand |

| Open Interest | Generally lower due to niche market | High, due to global trading volume |

| Data Frequency | Limited data, less transparency | Highly transparent and real-time |

| Reaction to Copper Prices | Indirect correlation via FMCG and pharma sectors | Direct correlation via industrial demand |

| Seasonal Influence | High (planting & harvesting seasonality) | Medium (heating oil demand in winters) |

| Speculative Activity | Moderate, mostly regional players | Very high, including hedge funds and speculators |

| Regulation | Subject to SEBI, FMC guidelines | Regulated by international exchanges (NYMEX, ICE) |

Option Chain Behavior During Volatility

1. Open Interest (OI) Surges

In times of price uncertainty, both mentha and crude oil see a rise in open interest. However, the nature differs:

- Crude oil attracts more institutional and international interest.

- Mentha oil sees a surge from local hedgers and small-scale investors.

2. Implied Volatility (IV) Spikes

Both commodities show higher IV during volatility, but crude oil’s response is often sharper due to global influences.

Example: During the Russia-Ukraine crisis, crude oil IV spiked drastically, while mentha oil saw only a marginal increase.

3. Put/Call Ratio Shifts

- In crude oil, a rise in the Put/Call ratio often indicates bearish sentiment due to global cues.

- In mentha oil, it may suggest a bumper crop season or falling export demand.

4. Straddle/Strangle Strategies Increase

Market participants adopt neutral strategies like straddles and strangles in both commodities to capitalize on heightened volatility.

Key Takeaways for Market Participants

| Participant | Mentha Oil Option Chain Strategy | Crude Oil Option Chain Strategy |

| Farmers | Use put options to hedge against falling prices | N/A |

| FMCG Companies | Hedge long-term procurement contracts | N/A |

| Investors | Buy calls in anticipation of weather-related supply drops | Sell calls during demand downturn |

| Speculators | Trade based on planting reports or govt policy | Capitalize on global events like war, embargoes |

| Analysts | Monitor mentha oil rate today, rainfall, and exports | Track crude oil option chain, OPEC+ decisions |

Interdependence with Other Commodities

Mentha and crude oil may seem unrelated, but in the real economy, they’re part of an intertwined commodities web. Mentha oil, used in balms and oils, is affected by crude-based packaging costs. Similarly, copper MCX live prices help predict industrial growth which can influence both crude and mentha demand cycles.

Final Thoughts

Volatility is a constant in today’s commodity markets. By comparing the mentha oil rate today with indicators from the crude oil option chain and copper MCX live, market participants can create more informed, risk-averse strategies. While mentha oil remains a domestic agricultural product with seasonal drivers, crude oil acts as a macroeconomic barometer of the global economy.

Understanding their option chain behaviors side-by-side empowers investors with the clarity needed to act decisively during uncertain times. Whether you’re a farmer, speculator, or an institutional investor, aligning your strategies with these insights can help navigate volatility with confidence.