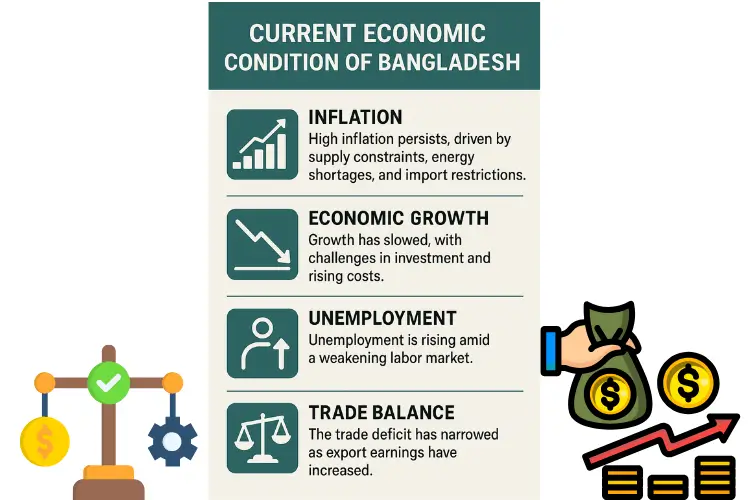

Bangladesh, once recognized as an emerging development success story, now faces a mix of progress and new economic headwinds. The current economic condition of Bangladesh reflects a country navigating through post-pandemic recovery, global inflationary pressure, and domestic policy challenges.

Economic Condition of Bangladesh

While sectors like garments and agriculture continue to show resilience, issues such as rising inflation, foreign currency shortages, and declining foreign reserves have raised serious concerns. At the same time, ongoing global uncertainty and geopolitical tensions have further complicated the outlook for 2025.

Understanding these dynamics is essential for policymakers, investors, and citizens alike. This article provides an in-depth look at the economic performance, key challenges, and future prospects of Bangladesh, backed by recent data and sectoral insights.

GDP Growth and Economic Performance

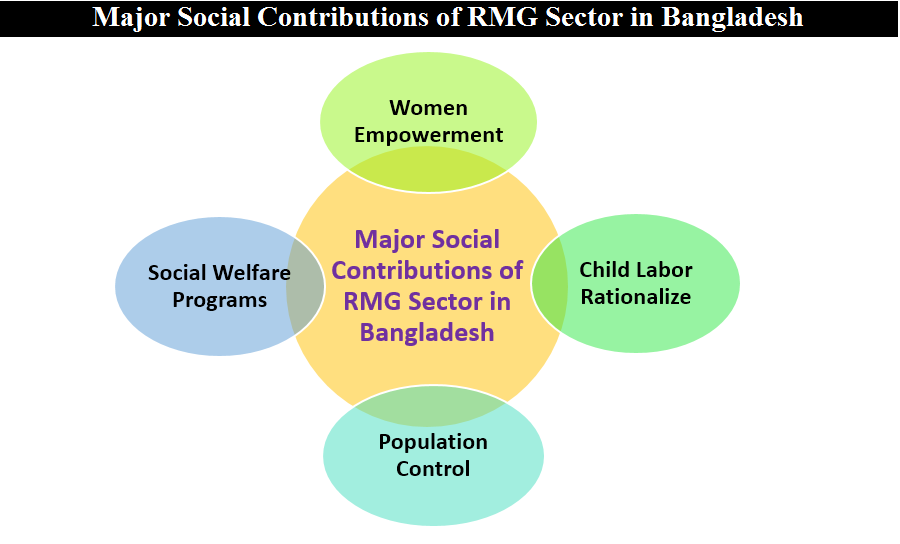

Over the past two decades, Bangladesh has been widely praised for its robust economic growth, driven by the ready-made garment (RMG) sector, agricultural development, and a growing services industry. However, the current economic condition of Bangladesh presents a more mixed picture as it grapples with both global and domestic pressures.

Recent GDP Growth Trends

According to the Bangladesh Bureau of Statistics (BBS) and projections from the International Monetary Fund (IMF):

- Bangladesh’s GDP growth rate stood at 5.8% in FY 2022-23, a decline from the 7.1% achieved in FY 2021-22.

- The slowdown reflects the impact of rising global commodity prices, energy shortages, and supply chain disruptions.

- The World Bank projects GDP growth to hover around 5.6% in FY 2023-24, with risks of further moderation depending on global market volatility.

Sectoral Contributions to GDP

The economy of Bangladesh remains heavily reliant on a few key sectors:

1. Agriculture (approx. 12.5% of GDP)

- Agriculture continues to be the backbone of rural livelihoods.

- Growth in this sector remains stable but limited, constrained by land scarcity, climate shocks, and input costs.

2. Industry (approx. 35.4% of GDP)

- The RMG industry, which accounts for over 80% of exports, is the primary driver.

- Despite global demand fluctuations, industrial production remains steady, with diversification efforts into leather, pharmaceuticals, and IT gaining pace.

3. Services (approx. 52.1% of GDP)

- Banking, telecommunications, real estate, and trade contribute heavily to this sector.

- Digital service adoption and e-commerce are expanding rapidly, especially among the urban youth.

Urban-Rural Economic Disparity

- While urban centers like Dhaka and Chattogram enjoy higher economic productivity, rural regions still lag behind in terms of infrastructure, access to finance, and employment opportunities.

- Bridging this gap is critical to ensure inclusive and sustainable growth.

Inflation and Price Levels

One of the most pressing concerns when assessing the current economic condition of Bangladesh is the high and persistent inflation rate, which has significantly affected the cost of living for millions. Inflation has emerged as a core economic challenge, undermining purchasing power, reducing real income, and posing a threat to macroeconomic stability.

Current Inflation Trends

As of early 2024:

- Consumer Price Index (CPI) inflation remained above 9%, with food inflation surpassing 10% in several months.

- According to the Bangladesh Bank and BBS, this is one of the highest inflation rates in over a decade.

Major factors driving inflation:

- Global commodity price volatility — driven by post-pandemic disruptions and the Ukraine-Russia conflict.

- Taka depreciation — raising the cost of imported goods, including essentials like fuel, cooking oil, and wheat.

- Energy shortages and power rationing — impacting production and supply chains.

- Speculative market behavior — especially in food items during peak seasons like Ramadan.

Impact on Food and Essentials

- Essential items such as rice, lentils, onions, and edible oil have seen double-digit price increases year-on-year.

- For low- and middle-income households, this has resulted in a significant decline in disposable income, forcing many to reduce consumption or rely on lower-quality substitutes.

Government Policy Measures

To control inflation, the government and Bangladesh Bank have adopted several strategies:

- Interest rate tightening – raising policy rates to curb liquidity.

- Import restrictions – to control demand for foreign exchange.

- Open Market Sales (OMS) – subsidized sale of essential goods to support the poor.

- Cash assistance programs for low-income families to cushion inflationary impacts.

However, critics argue that these measures are insufficient or poorly targeted, and inflation remains structurally embedded due to supply-side bottlenecks and fiscal limitations.

Public Sentiment and Confidence

- Public dissatisfaction over price hikes is growing.

- Frequent protests and strikes by various professional groups, including transporters, garment workers, and farmers, have emerged as a response to soaring living costs.

Foreign Exchange Reserves and Currency Situation

A crucial element of the current economic condition of Bangladesh is its foreign exchange (forex) reserve status and the volatility of the Bangladeshi Taka (BDT). In recent years, these indicators have reflected mounting pressure on the country’s external balance, particularly due to rising import bills and slowing inflows of dollars.

Status of Foreign Exchange Reserves

- Bangladesh’s forex reserves, which stood at over $46 billion in 2021, have declined significantly to around $19–22 billion in 2024 (according to Bangladesh Bank reports).

- The fall has been driven by:

- Increased spending on imported fuel, food, and industrial goods

- Stagnant remittances and a trade deficit

- Repayment of external debt obligations

- This reserve level now covers less than 4 months of import expenses—below the IMF’s recommended 6-month threshold.

Taka Depreciation and Its Impact

- The Bangladeshi Taka has depreciated sharply, from around BDT 84/USD in 2021 to BDT 115–120/USD in 2024.

- Key consequences:

- Imported inflation: Prices of essential imported goods have surged.

- Higher cost of servicing foreign loans, increasing fiscal stress.

- Reduced investor confidence in the stability of the currency.

- Export competitiveness has improved slightly, but not enough to offset the trade imbalance.

Policy Responses by Bangladesh Bank

To mitigate the crisis:

- Bangladesh Bank has implemented a market-based exchange rate regime.

- Import restrictions and higher LC margins were imposed to limit dollar outflows.

- Swap arrangements and short-term borrowing from international institutions (IMF, ADB) have been used to stabilize reserves.

Still, these are temporary relief measures, and the underlying structural issues remain unresolved.

Outlook and Investor Concerns

- Forex reserves may remain under pressure unless there is a significant boost in exports and remittances.

- Investors remain cautious, especially in sectors dependent on imports or foreign debt financing.

- Rating agencies have lowered Bangladesh’s economic outlook, citing external vulnerabilities.

Export and Import Trends

In examining the current economic condition of Bangladesh, it’s essential to understand the trends in exports and imports, as these directly affect trade balance, currency reserves, and overall economic sustainability. Bangladesh has historically run a trade deficit, and recent developments have further intensified these imbalances.

Export Performance

Bangladesh’s exports are heavily concentrated in the Ready-Made Garment (RMG) sector, which accounts for over 80% of total export earnings.

Key facts and recent trends:

- In FY 2022–23, export earnings were around $55 billion, with RMG contributing nearly $45 billion.

- Despite global inflation and recession fears, the RMG sector showed resilience, especially in European and North American markets.

- Non-RMG exports—like leather, jute, agricultural goods, IT services, and pharmaceuticals—have grown but remain relatively small in volume.

Challenges in the export sector:

- Overdependence on low-cost garment manufacturing.

- Rising energy costs and load shedding, which disrupt production.

- Increasing compliance requirements in Western markets (e.g., ESG standards, labor rights).

- Currency volatility affecting price competitiveness.

Import Trends and Challenges

Imports have grown substantially due to the country’s dependence on foreign goods for:

- Energy and fuel

- Industrial raw materials

- Capital machinery

- Food and essentials

In FY 2022–23, imports reached nearly $82 billion, resulting in a $27 billion trade deficit.

Major concerns:

- Fuel and LNG imports account for a significant portion of the import bill.

- High logistics and freight costs have not fully normalized post-COVID.

- Import controls imposed by Bangladesh Bank (e.g., restrictions on luxury items, higher LC margins) have temporarily slowed import growth.

Trade Deficit and Balance of Payments (BoP)

- The trade deficit and declining remittance inflow have widened the current account deficit, contributing to pressure on forex reserves.

- The BoP crisis has led to tighter monetary policies and further scrutiny of imports and foreign transactions.

Opportunities and Way Forward

- Export diversification into technology, agro-processing, and skilled outsourcing is essential.

- Improving port efficiency, energy availability, and ease of doing business could help boost export competitiveness.

- Trade agreements and regional economic integration (e.g., with SAARC or ASEAN) may open new markets.

Remittances and Overseas Employment

Remittances play a vital role in Bangladesh’s economy, significantly influencing the current economic condition of Bangladesh by supporting household consumption, foreign exchange reserves, and poverty reduction. However, recent trends show that this once-stable lifeline is facing structural and policy challenges.

Trends in Overseas Employment

- Bangladesh has over 13 million expatriate workers abroad, primarily in the Middle East, Southeast Asia, and Europe.

- In 2022–2023, approximately 1.1 million workers were deployed abroad—a record high—following a post-pandemic rebound.

- However, many of these jobs are low-skilled and vulnerable, with limited labor rights and wage protections.

Emerging destinations:

- Japan, South Korea, Romania, and Poland are becoming new markets for semi-skilled and skilled labor.

- Government-to-government (G2G) agreements are being explored to reduce dependency on exploitative middlemen.

Remittance Inflow Performance

- Remittance inflows stood at around $21.5 billion in FY 2022–23, slightly down from pre-pandemic levels.

- A significant portion of remittances still flows through informal channels (hundi) due to better rates and fewer regulations.

Challenges affecting remittance growth:

- Widening gap between official and unofficial exchange rates.

- Lack of incentives for formal remittance channels.

- High migration costs leading to worker debt and delayed remittance flow.

- Job insecurity and wage cuts in host countries due to global economic pressures.

Policy Measures and Incentives

The government and Bangladesh Bank have introduced several initiatives:

- 2.5% cash incentive on remittance sent through formal channels.

- Digital remittance platforms have been encouraged.

- Partnerships with mobile financial services (MFS) like bKash and Nagad to make receipt easier in rural areas.

Still, the impact has been limited due to lack of awareness, procedural delays, and unattractive exchange rates.

Strategic Importance of Remittances

Remittances:

- Support domestic consumption and reduce poverty, especially in rural regions.

- Strengthen foreign exchange reserves, which are critical amid declining exports and rising imports.

- Offer a counterbalance to the trade deficit.

Investment Climate and Industrial Growth

The current economic condition of Bangladesh is closely tied to how conducive the country’s environment is for both domestic and foreign investments. While Bangladesh has long been viewed as a rising frontier economy with significant potential, recent challenges—including infrastructure bottlenecks, currency volatility, and regulatory uncertainties—have affected investor sentiment.

State of Industrial Growth

- Bangladesh’s industrial sector accounts for about 35% of GDP, driven largely by the ready-made garments (RMG) industry, construction, textiles, and light engineering.

- Despite global economic headwinds, some sub-sectors have demonstrated resilience, including:

- Pharmaceuticals (with a growing export base),

- Ceramics and FMCG (expanding local markets),

- IT and outsourcing (freelance and BPO sectors are booming).

However, power shortages, raw material import costs, and policy inconsistency are slowing industrial expansion.

Foreign Direct Investment (FDI) Trends

- FDI inflow has remained moderate, hovering between $2.5–3.5 billion annually in recent years.

- Major investors include China, Japan, South Korea, the UK, and the USA.

- Investments have mainly targeted power and energy, telecom, financial services, and EPZs (Export Processing Zones).

Key concerns among foreign investors:

- Currency depreciation and dollar crisis.

- Lengthy approval processes and bureaucratic red tape.

- Inconsistent tax policies and regulatory unpredictability.

- Infrastructure constraints (logistics, power supply).

Government Initiatives to Improve Investment Climate

- The Bangladesh Investment Development Authority (BIDA) launched the One Stop Service (OSS) platform to simplify procedures.

- Development of 100 Economic Zones (EZs) and several Hi-Tech Parks to attract FDI and facilitate industrial decentralization.

- Recent Public-Private Partnership (PPP) projects and incentive packages aim to boost investor confidence.

While these are positive steps, implementation and transparency remain areas of concern.

Private Sector Investment Trends

- Domestic private investment has slowed due to:

- High interest rates and inflation.

- Reduced consumer demand.

- Uncertainty around future tax and subsidy reforms.

Many businesses are holding off on expansion, focusing instead on survival and cash flow management.

Infrastructure Development: A Double-Edged Sword

- Mega projects like the Padma Bridge, Metro Rail (Dhaka MRT), Elevated Expressways, and Deep Sea Port are transforming logistics and trade routes.

- However, these projects are mostly debt-financed, raising concerns over debt sustainability in the current forex-constrained environment.

Social Indicators and Employment Trends

The current economic condition of Bangladesh cannot be fully understood without assessing key social indicators such as employment, education, poverty, and income distribution. These elements not only reflect the standard of living but also influence the long-term sustainability of economic growth.

Employment Landscape

- Total labor force: Over 70 million, with a youthful demographic—nearly 60% under the age of 35.

- Employment distribution:

- Agriculture: ~37%

- Industry: ~21%

- Services: ~42%

While the economy has diversified, underemployment and informal employment dominate:

- Over 85% of employment is informal, lacking social protection, job security, or benefits.

- A significant number of workers are self-employed or engaged in vulnerable occupations.

Education and Skill Development

- Literacy rate: Approximately 75%, with improvements in primary and secondary education enrollment.

- However, there’s a skills mismatch:

- Graduates lack industry-ready skills.

- Vocational and technical education remain underutilized.

- English and IT proficiency need substantial improvement to compete globally.

Efforts like Skill for Employment Investment Program (SEIP) and private sector training programs are helping, but more scale and alignment with job market demands are needed.

Poverty and Inequality

- Poverty rate declined from over 40% in 2005 to 18.7% in 2022, but recent inflationary shocks may reverse this progress.

- Extreme poverty still affects 5%–6% of the population, especially in coastal and remote rural areas.

- Income inequality has widened, with the richest 10% holding more than 38% of the nation’s income, while the poorest 10% account for less than 2%.

Health and Social Protection

- Life expectancy: ~73 years; maternal and infant mortality rates have improved drastically.

- Social protection coverage is limited and fragmented, often failing to reach the most vulnerable populations.

- Programs like old-age allowance, widow allowance, disability support, and food for work exist but suffer from underfunding and mismanagement.

Urbanization and Job Creation Pressure

- Rapid urbanization is straining infrastructure and creating slums with poor living conditions.

- Each year, 2 million new job seekers enter the market, but quality job creation lags far behind.

- The gig economy and digital freelancing have emerged as alternatives, especially among youth.

Challenges, Outlook, and Way Forward

The current economic condition of Bangladesh reflects both impressive strides and emerging threats. To sustain growth, reduce inequality, and stabilize macroeconomic fundamentals, the country must confront its present challenges with strategic reforms and forward-looking policies.

Major Economic Challenges

- Macroeconomic Instability

- Persistent inflation is eroding purchasing power, especially for lower-income groups.

- The taka’s depreciation has made imports costlier and increased the burden of external debt.

- Foreign exchange reserves have dwindled, impacting essential imports and investor confidence.

- Fiscal and Financial Sector Weaknesses

- Budget deficit management is becoming difficult with falling revenue collection.

- High default loan ratios (non-performing loans) are threatening banking sector health.

- Limited access to affordable finance for SMEs is stifling entrepreneurship.

- Trade Imbalance and Global Headwinds

- Sluggish export growth due to slowing global demand.

- Remittance inflows, though significant, have shown fluctuations.

- Rising freight costs and international interest rates add pressure.

- Employment and Demographic Pressures

- The economy is not generating enough formal jobs for a growing youth population.

- Skills mismatch and low labor productivity reduce competitiveness.

- Climate Change and Sustainability

- Frequent natural disasters, salinity intrusion, and river erosion threaten agriculture and livelihoods.

- Bangladesh is highly vulnerable to climate-induced displacement and food insecurity.

Economic Outlook

- Short-term: Moderate GDP growth (~5.5% projected for FY 2024–25), with inflation risks and balance of payment challenges persisting.

- Medium to long-term: Growth prospects remain strong if structural reforms, infrastructure improvements, and industrial diversification are sustained.

Positive drivers:

- The Padma Bridge and other mega projects are expected to boost connectivity and trade.

- Expansion into IT, pharmaceuticals, and agro-processing may reduce overdependence on RMG.

- Increasing public-private partnerships can unlock investment.

Way Forward

- Strengthen Macroeconomic Management

- Restore reserve buffers and stabilize the exchange rate.

- Improve monetary policy transparency and inflation targeting.

- Reform the Banking and Financial Sector

- Enforce stricter regulations on loan recovery and banking governance.

- Promote financial inclusion through fintech innovation.

- Enhance Business and Investment Environment

- Simplify tax policies and digitize regulatory services.

- Accelerate special economic zones (SEZs) and export diversification strategies.

- Invest in Human Capital

- Expand vocational and STEM education aligned with market needs.

- Incentivize innovation and digital literacy among youth.

- Adapt to Climate Risks

- Scale up climate-resilient agriculture and renewable energy investments.

- Develop better flood protection, drainage, and coastal zone management systems.

Final Thoughts

Bangladesh stands at a crossroads. Despite global uncertainties and internal pressures, the country’s strong demographic dividend, strategic location, and entrepreneurial spirit offer hope. With bold reforms, resilient governance, and inclusive development strategies, Bangladesh can not only stabilize its economy but also lead as a dynamic, middle-income nation in South Asia.

Written by: Md. Nahian Mahmud Shaikat

nice work bro. very much informative

you are superb. thank you

It’s my pleasure..thank you too

ref bro

In 2015 all these data were collected from Bangladesh Bureau of statistics, Bangladesh Bank, and Wikipedia.