The Portfolio Management Process

Before discussing the portfolio management process lets have some idea of a portfolio, basically, portfolio management process is the set of securities or combination of investment securities.

The process of managing a group of investment or portfolio is never stopping, it is a continuous process. An investor needs to develop plan and policies to form a portfolio, monitor the performance and review portfolio from time to time.

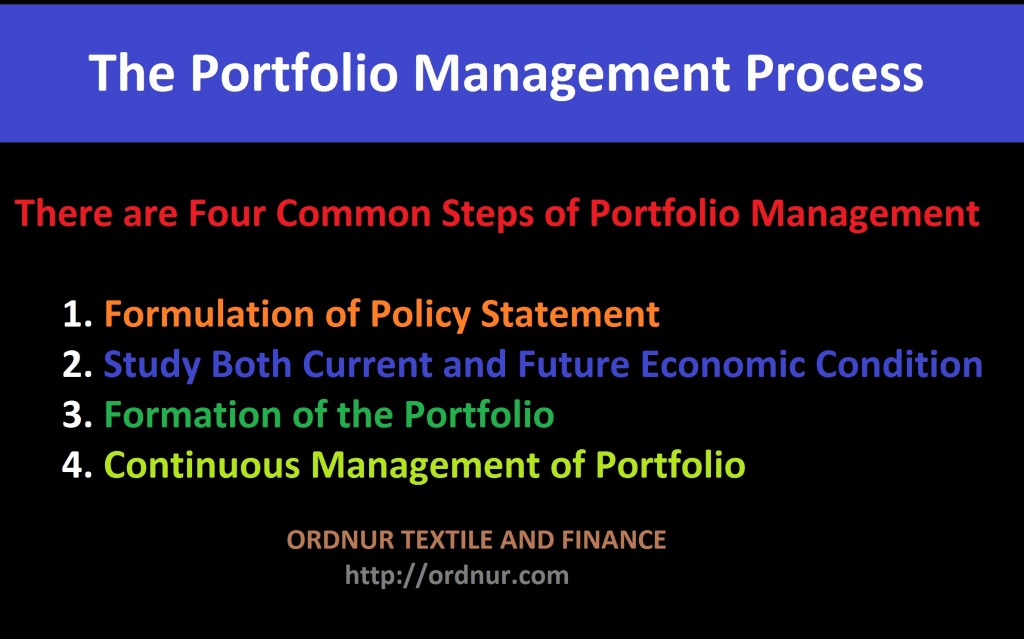

The portfolio management process is followed by four common steps, these are:

- The first step of portfolio management is the formulation of policy statement either individually or get assistance from others. This policy statement is the roadmap of how much an investor is willing to take a risk.

- In the second step, a manager should study the current financial and economic condition to forecast the future economic return or condition. An economy is dynamic which is continuously changing over the time because of the direct or indirect impact of the micro and macroeconomic variables.

- The third step of the portfolio management process is the formation of a portfolio according to the policy statement and risk-taking behavior of the investor. The portfolio should be formed by using both a risk-free asset and risky asset so that ultimately risk can be minimized.

- The final step of the portfolio management is the continuous monitoring by the portfolio managers so that any investment correction can be done as required. Mainly investment should be concentrated with capital gain and fprofit via a dividend.

These above four-steps basically used for managing the portfolio by the investor or by the portfolio manager.

***If you like our articles then please do not forget to comment. Your feedback will help us to share a new article as per your interest.

Written by

Institute of Business Administration (IBA)

Jahangirnagar University

Email: [email protected]