What are the determinants of the time value of money? The time value of money is the most important concept of finance. The main thing of the time value of money is that the value of dollar 100 now is more than the value of dollar 100 after some time. That is the value of money today is more than the value of money after some time. When making any investing or financing decision we have to consider this idea, otherwise, we may incur some loss of benefit. To calculate the present value of any fund this time value concept is used to identify the required rates of return.

The idea that money available at the present time is worth more than the same amount in the future because of the potentiality of future earnings. This core principle of finance holds that provided money can earn interest, any amount of money is worth more the sooner it is received.

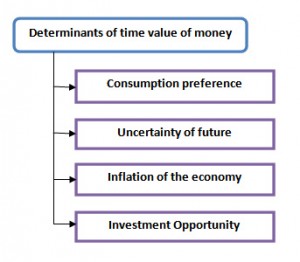

Determinants of the time value of money

There are several determinants that are used to calculate the actual value of the money. Four commonly used determinants are:

- Consumption preference of a person

- Uncertainty of future

- Inflation of the economy

- Investment Opportunity

Consumption preference of a person

People prefer current consumption for future consumption if there is the same level of satisfaction. Most of the people are ready to sacrifice the current consumption if they find that in the future they will be able to consume more than the present. A higher rate of return that is more than the required rates of return is mainly leading them to take the decision of sacrifice of current consumption. Some people think that the future is uncertain so it’s better to consume now although they are not concern about the benefit of the future.

Uncertainty of future

The future is always uncertain. Nobody knows what will happen in the future. So it is better to consume now rather than consume in the future if the current consumption rate is more. People would like to compensate for uncertain future cash flow against certain cash flow.

Inflation of the economy

Inflation is related to the purchasing power of money. With time the purchasing power of money is decreased. Every economy has inflation but the rate is different from country to the country economy. If there is higher inflation then the required rates of return of investors are higher. For a higher inflationary economy, consumers prefer current consumption rather than future consumption.

Investment opportunity

Time value of money considers the idea of reinvestment that is if an investment generates cash inflow periodically then this periodic return can be reinvested which will generate a higher return. If the cash flow comes now, it can be invested and generate additional cash flow, therefore whatever may be the cash flow now. The future cash flow is more than its present cash flow.

Love the essay form and clear explanation it’s wonderful