14 Importance of Learning Finance

You know finance is not only receiving money from different sources but also proper utilization of money or financial resources. Here utilization means investing money in accordance with risk-taking behavior where the return is maximum. The main objective of financing is to ensure the right amount of money at the right time. For better economic and financial decision making you have to have basic knowledge of finance and financing. Every day we take financial decisions although we are not aware of, we are actually doing financing like a corporate finance manager. If you want to make a better financial decision then you must know the core financing principles. Here in this article, I will clarify the 14 importance of learning finance both for the individuals, corporate finance manager, and organization.

The reason I want to discuss the importance of learning finance is to motivate you to learn finance and apply it in your daily life which will help you to become a better decision-maker.

How to Learn Finance and where to learn Finance?

It is not easy to learn finance if you are not aware enough to think about it deeply and understand the scenarios and logic behind the financing principles. I personally follow different strategies to learn finance as much as I can. As an individual, you have a lot of scopes to learn finance and it can be:

- Academic Learning of Finance

- You can do graduation or post-graduation in finance and also get a CFA degree if you have passion enough.

- Professional Training

- Institutional Training

- On the Job Training

- Online Training Course

- Self-Learning

- Reading Books

- Study Research Paper, Journal, articles

- Watch online lectures or tutorials

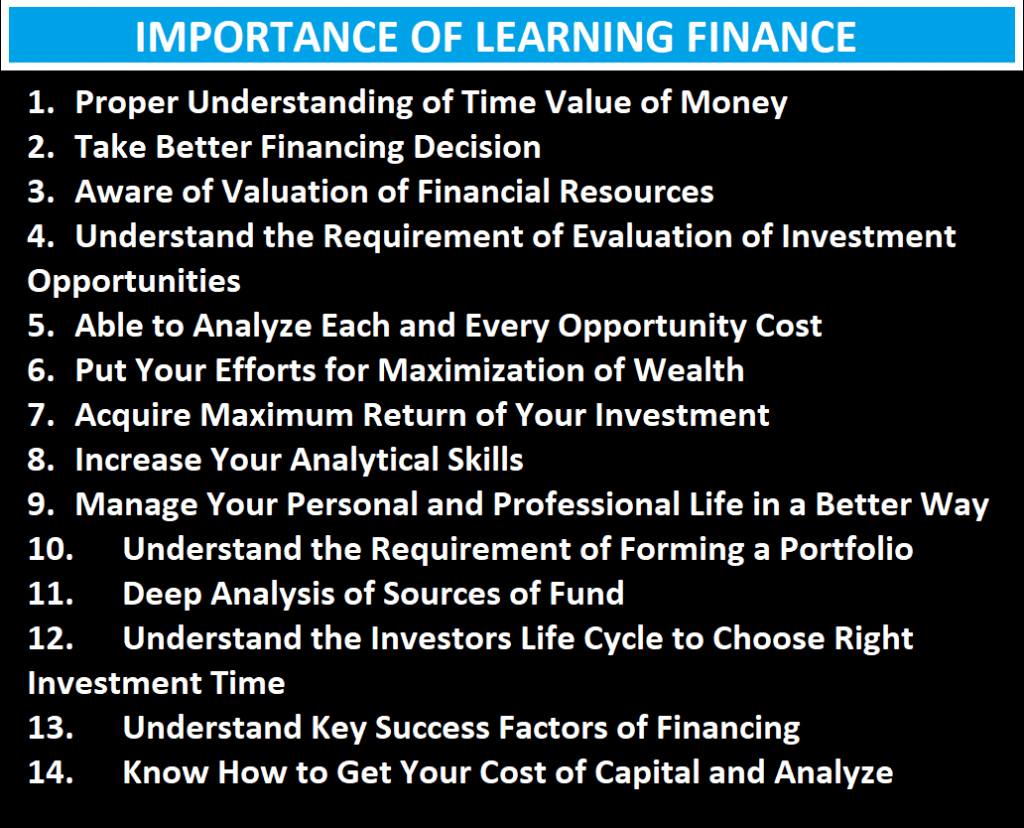

List of 14 Importance of Learning Finance

The importance of learning finance is given below which are listed from a different perspective. Hopefully, this will add value to your learning phase.

- Proper Understanding of Time Value of Money

- Take Better Financing Decision

- Aware of the Valuation of Financial Resources

- Understand the Requirement of Evaluation of Investment Opportunities

- Able to Analyze Each and Every Opportunity Cost

- Put Your Efforts for Maximization of Wealth

- Acquire Maximum Return of Your Investment

- Increase Your Analytical Skills

- Manage Your Personal and Professional Life in a Better Way

- Understand the Requirement of Forming a Portfolio

- Deep Analysis of Sources of Fund

- Understand the Investors Life Cycle to Choose Right Investment Time

- Understand Key Success Factors of Financing

- Know-How to Get Your Cost of Capital and Analyze it

Take Better Financing Decision

The most important thing is to take a better financing decision as every financing decision both for borrowing and lending is related to cost and benefit. A better financing decision will bring financial success which is expected by every individual.

Proper Understanding of Time Value of Money

If you actually want to know finance then you must know the concept of the time value of money that with time passes the value of your money is decreased. So, to ensure value maximization you are to invest in a way that increases the net present value of your wealth.

Aware of the Valuation of Financial Resources

As an investor of both money and capital market, please make sure that you do proper valuation otherwise you may lose your valuable financial resources. That’s why every investor needs to be aware of the valuation of financial resources or instruments.

The Requirement of Evaluation of Investment Opportunities

The proper understanding of the requirement of evaluation of investment opportunities will induce you to do capital budgeting (NPV, IRR, PBP, MIRR, PI, etc.). Both long-term and short-term investment opportunities need to be evaluated, especially for long-term investment opportunities.

Able to Analyze Each and Every Opportunity Cost

Every decision we are taking in our daily life we forgo other opportunities, so it is required to do an evaluation of opportunity cost and invest where your opportunity cost is lower. The investment decision is actually dependent on the behavior of investors.

Acquire Maximum Return of Your Investment

You need to learn finance because investors always intention are to ensure maximize their return on their investment. Here, the maximum return will increase the value of your asset.

Put Your Efforts for Maximization of Wealth

A financially sound person always tries to put all of his/her efforts for the maximization of wealth. Maximization of wealth will bring more profit for you or for your organization.

Deep Analysis of Sources of Fund

Whenever you plan for the collection of funds you may find several short terms or long-term sources. If you have adequate knowledge of financing then you will be able to do a deep analysis of sources of funds. But one thing is you must know financing concepts and how it works.

Know-How to Get Your Cost of Capital and Analyze

Whatever the amount of capital, is not free of cost. Every capital has a cost, so before taking an investment decision you have to calculate and analyze the cost of capital but before that, you must know the finance. That’s why there is a huge importance in learning financing.

Understand the Requirement of Forming a Portfolio

After knowing finance properly, you must know what is a portfolio and why we form a portfolio. A portfolio is a set of a different mixture of investment where both risk-free and risky investment is there, the main purpose is to decrease the overall risk of investment. If you learn finance then you must know how to form a portfolio both for individuals and organizations.

Manage Your Personal and Professional Life in a Better Way

If you want to become a financially sound person then you must know finance and after that, you will be able to manage your personal and professional life in a better way. Your financial strength will be increased by the right financing decision.

Understand the Investors Life Cycle to Choose Right Investment Time

Be aware of an investor’s life cycle and choose when to invest and when to save your valuable money. Your money is your asset, it is your decision whether you want to grow it by investing it at the right time.

Understand Key Success Factors of Financing

Behind every successful finance manager, a secret is there, the secret is understanding the key success factors and application of the factors at the right time in the right place.

Increase Your Analytical Skills

Ultimately by knowing finance deeply, you will be able to increase your analytical skills. You will be able to take good financing decisions which will give you financial freedom, maximize your wealth, and increase your spending power.

If you have any confusion about anything related to the importance of learning finance then please let me know, I will try to clarify it further.

Written by