Financing involves gathering funds for strategic investment, ensuring their effective utilization. This process adheres to six core principles of finance, aimed at maximizing benefits. The individual overseeing these funds is commonly referred to as a financial manager. In essence, finance entails the proficient management of resources. Acquiring knowledge on financial management is pivotal, benefiting not just personal life but also business endeavors, both present and future. Doing a finance assignment can help you gain insights into economic trends and financial instruments as well as manage your funds effectively. In this article, we will briefly explain the principles of finance.

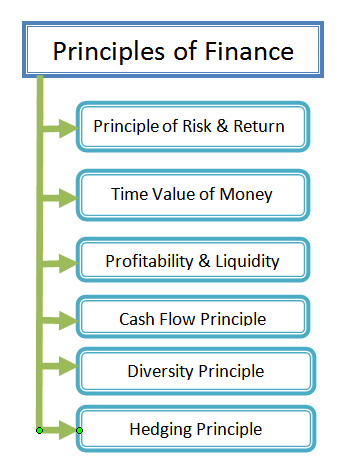

Principles of Finance

Principles act as a guideline for investment and financing decisions. Financial managers take operating, investment, and financing decisions. Some of this is related to the short term and some long term. The 6 Principles of Finance everyone should Know whether it is for individuals or organizations.

There are six principles of finance you must know

- The Principle of Risk and Return

- Time Value of Money Principle

- Cash Flow Principle

- The Principle of Profitability and liquidity

- Principles of diversity and

- The Hedging Principle of Finance

Risk and Return

The principle of Risk and Return indicates that investors have to be conscious of both risk and return, because the higher the risk higher the rates of return, and the lower the risk, the lower the rates of return. For Business Financing, we may have to compare the return with risk. To ensure optimum rates of return, investors need to measure risk and return by both direct measurement and relative measurement.

Time Value of Money

This principle is concerned with the value of money, that value of money is decreased when time passes. The value of $1 of the present time is more than the value of $1 after some time or years. So before investing or taking funds, we have to think about the inflation rate of the economy and the required rate of return must be more than the inflation rate so that the return can compensate for the loss incurred by the inflation.

Cash Flow

The cash flow principle mainly discusses the cash inflow and outflow, more cash inflow in the earlier period is preferable to later cash flow by the investors. This principle also follows the time value principle that’s why it prefers earlier benefits rather than later years benefits. Seeking financial assistance from a legal money lender can further support businesses in managing their cash flow effectively, ensuring a steady and sustainable financial trajectory.

Profitability and Liquidity

The principle of profitability and liquidity is very important from the investor’s perspective because the investor has to ensure both profitability and liquidity. Liquidity indicates the marketability of the investment i.e. how easy to get cash by selling the investment. On the other hand, investors have to invest in a way that can ensure the maximization of profit with a moderate or lower level of risk. This is best overlooked by a qualified accountant to ensure all tax obligations are met.

Diversity

This principle helps to minimize the risk by building an optimum portfolio. The idea of a portfolio is, never to put all your eggs in the same basket because if it falls then all of your eggs will break, so put eggs separated in different baskets so that your risk can be minimized. To ensure this principle investors have to invest in risk-free investments and some risky investments so that ultimately risk can be lower. Diversification of investment ensures minimization of risk.

Hedging Principles

The hedging principle indicates that we have to take a loan from appropriate sources, for short-term fund requirements we have to finance from short-term sources, and for long-term fund requirements, we have to manage funds from long-term sources. For fixed asset financing is to be done from long-term sources.

Finally, if you have a basic understanding of finance and its principles then you will be able to take financial decisions effectively. And there is a higher possibility to become financially gainer.

Written by

Md. Nahian Mahmud Shaikat

Financial Analyst

as i student of finance i like to read this type of article. Hope you will continue to present more and more informative things.

as a student also…..this article is more helpful to us……..am looking forward for more n more information…

THANK YOU

Thanks for your nice comment. Hope we will be able to share more and more

Really helps alot…looking forward for more useful and informative article as this ones

Thank your for your feedback. Hope you will get as expected.

I really appreciat your effort to explain in easy word very helpful article thanks .

helpful article and excellence keep continue help for others……

nice one

Thanks for your sharing your useful writing.

Your article has really help me.Thanks alot.Keep on the goodwork!

I was just looking for this information for a while. After 6 hours of continuous Googleing, at last I got it in your site. I wonder what’s the lack of Google strategy that don’t rank this type of informative sites in top of the list. Normally the top web sites are full of garbage.

Well put sir. Thank you

These types of articles are very much easy to understand for a student.

I like it very much 😍😍

Beautiful piece regarding finance, hope to read more from you.

Easy understand

I hope to useful mi

As a student I’m so happy reading this, it’s well explained and easily understood. Thank allot🙏🙏🙏 may you continue to feel us with that knowledge

Thank you for this concise explanation