The principles of financial management work as a guideline for managing financial activities. If you properly understand and apply the core principles in your financial activities then you will never become financially loser. To get the most benefit from a financial action, the person needs to be careful enough to handle and trade-off the risk and return.

Financial management is the process of managing the funds both for individuals and organizations to ensure proper utilization of funds. Core principles of finance are applicable in the case of principles of financial management.

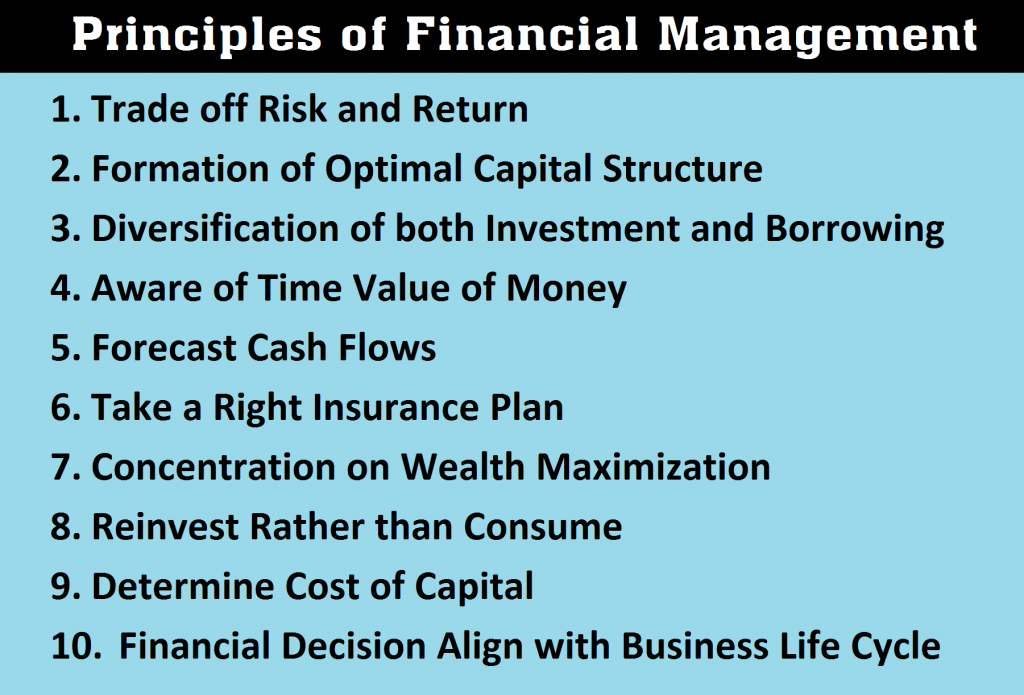

- Trade-off Risk and Return

- Formation of Optimal Capital Structure

- Diversification of both Investment and Borrowing

- Aware of Time Value of Money

- Forecast Cash Flows

- Take a Right Insurance Plan

- Concentration on Wealth Maximization

- Reinvest Rather than Consume

- Determine Cost of Capital

- Financial Decision Align with Business Life Cycle

Trade-off Risk and Return

Investors must be careful while forming a portfolio from available investment opportunities, the choice of investment is based on the individual’s trade-off between risk and return. There is a positive correlation between risk and return. Higher the risk and higher the expected rates of return. A portfolio should have lower risky investments combined with higher risk investment. A finance manager carefully deals with this risk and return which is the core principles of finance and financial management.

Formation of Optimal Capital Structure

Capital structure is the ratio of debt and equity percentage of total assets of a company. By looking into capital structure an investor easily can understand the financing pattern of an organization. A financially sound organization is to be more dependent on debt financing rather than equity financing. The reason is, own fund that is equity is costly than debt. So at the time of financing, it is the job of a CFO or finance manager to ensure the best mixing of debt and equity for the company so that the weighted average cost of capital remains minimum. You cannot overlook this principle because of its importance.

Diversification of both Investment and Borrowing

Forming portfolio through diversification both can be applicable for investment and borrowing. Keep in mind that, your target is to ensure the minimum cost of borrowing or financing and a maximum reward of your investment. This you need to concern while taking a decision is a balance between risk and return. So that overall monetary risk remains affordable.

Aware of Time Value of Money

Always be aware of the time value of money, otherwise, there is a possibility of becoming financially looser. Money receives at the current time is more valuable than the money receives after some time. So when you are responsible for handling the money you have to keep in mind the time value of money and the average rate of that reduction of value because of inflation or any other factors.

Forecast Cash Flows

Cash is the most liquid asset which flows inward or outward. The pattern of flows influences financial decisions. More reliable cash flows are preferable rather than the uncertain flow of cash. To ensure supply the required of cash for all the organizational activities it is necessary to forecast the cash flows and manage the cash based on the requirements. Holding the right amount of liquid funds is the expression of the utilization of financial management principles.

Take a Right Insurance Plan

A right insurance plan will help the organization to divert the risk to the insurance company. The diversion of risk possible in exchange for insurance premium which is paid by the insurance taker. A financial decision is involving with the choice of insurance policy and the amount of insurance premium is dependent on the nature of insurance policy. So as a part of financial management, your company should take a proper insurance plan.

Concentration on Wealth Maximization

Wealth maximization is the process of maximizing the value of an organization, i.e. the maximization of the net present value of an organization. As a finance manager or top management of an organization if you want to manage your financial condition then you must focus on how you can maximize the value of your organization. A wealthy company can invest more in innovative product development. This will help to grow a company much more smoothly.

Reinvest Rather than Consume

If your company has adequate financial strength, then not only consume what business is generating but also invest in the most beneficial opportunities. Reinvestment helps to broaden the business which generates employment, value-creating, and exchange of value to the economy. Good financial management practice is to always look for new opportunities if you find any worthy investment opportunities then go for reinvestment of available funds.

Determine Cost of Capital

Here cost of capital indicates the expenses associated with the payment which is charged on the supply of funds for debt and equity. The weighted average cost of capital is the actual cost of capital which is the average cost of both equity and debt financing cost. Effective financial management always does a comparison of financial rewards and the cost associated with that capital cost. If the expected rates of return are more than the cost of capital, then you can invest.

Financial Decision Align with Business Life Cycle

A business is always undergoing the ups and downs like a cycle. Whenever you make a financial decision, you must consider the current position in the business life cycle and forecasted position in the cycle. So that you can make a plan to ensure the ultimate financial benefit for your organization. A good financial plan helps to bring out the sweetest juice from the investment and financing opportunities. At the life span of a business, there may have a requirement of different financial decisions and that decision should match with the financial condition of that business.

Written by

Md. Nahian Mahmud Shaikat

Financial Analyst

EXCELLENT INPUTS.