Role of financial intermediaries in financing the corporate type of business in Bangladesh

Bangladesh is a developing country, where both the manufacturing and service sectors contributing together to our GDP (Gross Domestic Product). With the expansion of our economy individuals, organizations, or institutions are engaged with productive sectors, for this purpose they need funds. The question is who will manage and supply this fund?

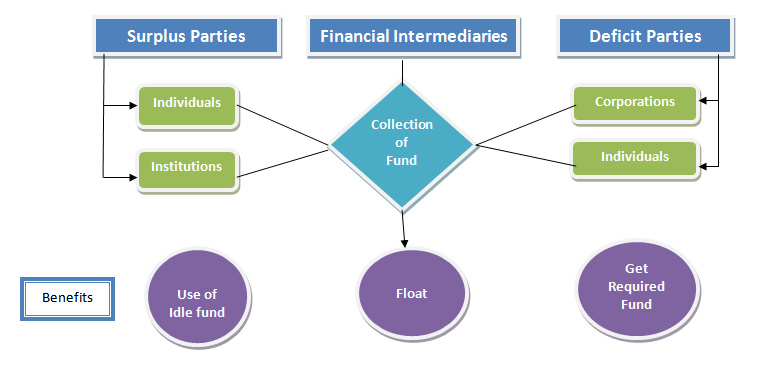

Basically, financial intermediaries (bank, non-bank financial institutions, investment bank) collect fund from surplus parties (those have extra idle money on hand) from an economy and then provides this fund to the deficit parties (those require fund) of the economy. For an individual, it is not easy to manage a huge amount of money within a short time, but in the case of financial intermediaries, it is possible because they have the mechanism of collecting funds and then provide it to the required parties. Although the direct transfer of funds is possible it is an inefficient one because there is a limitation of time, cost, and availability. On the other hand, through intermediation funds can be transferred from deficit to surplus and surplus to deficit.

A corporation or corporate types of business normally invest their huge amount of capital in profitable sources so that stockholders can get a reasonable amount of return to their investment. The corporation always tries to form an optimal capital structure by combining different ratios of debt and equity. When a company collects funds from the external sources it requires the help of financial intermediaries. Sometimes financing is done from a single financial institution or from two or more financial institutions. The choice of financial intermediaries depends on the cost of funds and the number of funds required.

The main thing is financial intermediary’s works as a media between the corporation’s (needs to collect fund) and surplus parties (individual or institutions), the float between these two parties is income for the financial intermediary.

In Bangladesh, you can find there are few giant corporate houses that funding their additional debt capital with the help of financial intermediaries. Corporations like Square group, Bashundhara group, Jamuna group, ACI Group of Companies, Beximco Group, Akij group, etc. already acquiring thousands of crore taka and financial intermediaries made it possible.

Let’s see how the actual intermediation process works and how financial intermediaries play a role in the corporate types of business in Bangladesh.

Example 1: Suppose an economy has 1000 individuals or institutions with 10000 surplus amounts of dollars each. But individually they cannot lend their money because it is hard for an individual to find deficit parties (those require funds) when they needed. Here available deficit fund is 10 Million dollars if these funds collected by the financial intermediaries then it will be easy to lend to the corporate. If there is 2 corporate need 5 million, other 2 corporate need 3 million, and another two corporate need total 2 millions of dollar then these funds can be financed by the intermediaries as they have 10 millions of dollars to be landed.

Example 2: In case of financing a large number of funds there is an involvement of higher risk and sometimes the amount of required funds is too much which is beyond the capacity of a single financial institution. In this case, a syndicated fund can be created by joining two or more companies together so that risk is minimized, and financing the larger amount would be possible for the corporate type business by the syndicate.

At the end of the discussion, we can identify that the financial intermediaries playing a great role in financing corporate type of business in Bangladesh through managing required funds at a time with a market interest rate. Because of the presence of financial intermediaries corporate get the benefit of lower search cost, higher liquidity, manage larger capital, etc.

Written by

Md. Nahian Mahmud Shaikat

Student of MBA

Institute of Business Administration (IBA)

Jahangirnagar University

Email: [email protected]