We know that the future is uncertain, and because of uncertainty; the involvement of risk can be traced to every part of life. When we talk about any investment we have to think about risk and return, the higher the risk higher the rates of return, and the lower the risk lower the rates of return. Our life is directly related to economic activities where risk is a considerable element that cannot be overlooked. It can provide the necessary knowledge and skills to make informed decisions in the dynamic world of finance, where risk and reward go hand in hand.

To minimize the risk people go for savings and some people take the help of insurance companies/ agencies by paying insurance premiums. Risk can be categorized into different perspectives but here we only discuss the business risk.

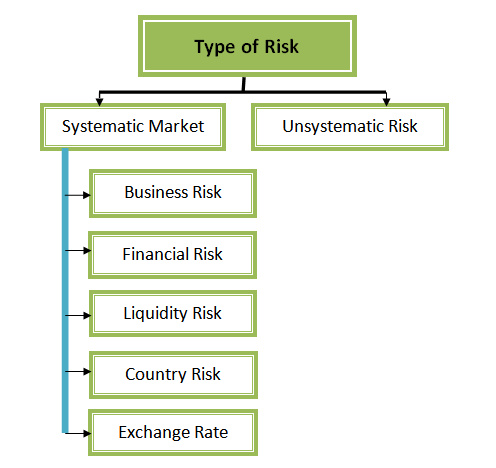

What are the Basic Types of Risk?

Before discussing the types of risk, let’s have some idea of risk. Risk is the deviation between the actual outcome and the expected outcome. Some risks can be minimized and some risks cannot be minimized. Some risks arise from the microeconomic factor and some from macroeconomic factors.

The basic types of risk that we may find are:

Unsystematic Risk

Unsystematic risk is that portion of risk that can be minimized through diversification of the investment by forming a portfolio. If we form a portfolio using the negatively correlated investment securities then it would be possible to minimize the risk at a lower level. This type of risk is known as diversifiable risk Theoretically it is possible to eliminate the portion of unsystematic risk but in a real sense, it is not possible to eliminate the risk through diversification.

Systematic Risk

Systematic risk is that portion of risk that cannot minimize through diversification of the investments. Systematic risk mainly arises from macroeconomic variables which are beyond our control. Beta is the measure of systematic risk. Sometimes this risk is also known as systematic market risk. Sources of systematic risk are given below with a short explanation.

Business Risk

Business risk is the risk that mainly arises when a firm or business organization is unable to generate sufficient revenue to maintain its operating expenditure through providing services or selling products, that is risk is directly related to the operation of the firm.

Financial Risk

When a firm is unable to pay off its fixed financial obligation then this type of risk may arise. This type of risk is involved with the levered firm which uses debt capital for business. In some cases, this risk can lead a company to bankruptcy.

Liquidity Risk

This risk is involved with the marketability of a security or investment which is the capacity to generate assets into cash as much quicker as possible. If an investment takes less time to convert into cash then it is a liquid asset or investment.

Country Risk

The unstable political condition of a country is responsible for this type of risk. If this risk is more than an economy definitely fall, so does business. In Bangladesh, this type of risk is higher.

Exchange Rate Risk

The exchange of currency is required when a country is involved with import and export. For importing products or services foreign currency basically the dollar is used. So if there is more fluctuation of the exchange rate frequently then a business may incur loss. This probable loss is a risk for the business.

Although every economic activity is involved with risk, we need to be more cautious to minimize the risk. If we can minimize the risk of doing business then it will be possible to generate profit for the company/ business organization.

Written by

Md. Nahian Mahmud Shaikat

Student of MBA

Institute of Business Administration (IBA)

Jahangirnagar University

Email: [email protected]