If you have the plan to become a Financial Analyst (FA), then you must know the responsibilities and Functions of Financial Analyst that is to know about what does a financial analyst does. So that you can prepare yourself accordingly. Several times many people ask me what is finance and what does a financial analyst does. For them, I have listed 5 questions with the answer to helping them understand.

- Who are the financial analysts (FA)?

- What are the responsibilities and functions of an FA? Or what does he do?

- Is there any Demand for Analyst?

- What are the Educational Qualifications Required to become an analyst?

- Why your company should have at least one analyst?

Who are the Financial Analysts?

Financial Analysts are the individuals responsible to do financial analysis. But their responsibilities and functions are not limited to only financial analysis. They do economic analysis, business process analysis, market analysis, and many other things. A person who is involved with the analysis of financial matters is considered as a financial analyst (FA). They are the key to financial decision-makers and their business decision is based on extensive financial analysis.

What does a Financial Analyst Do?

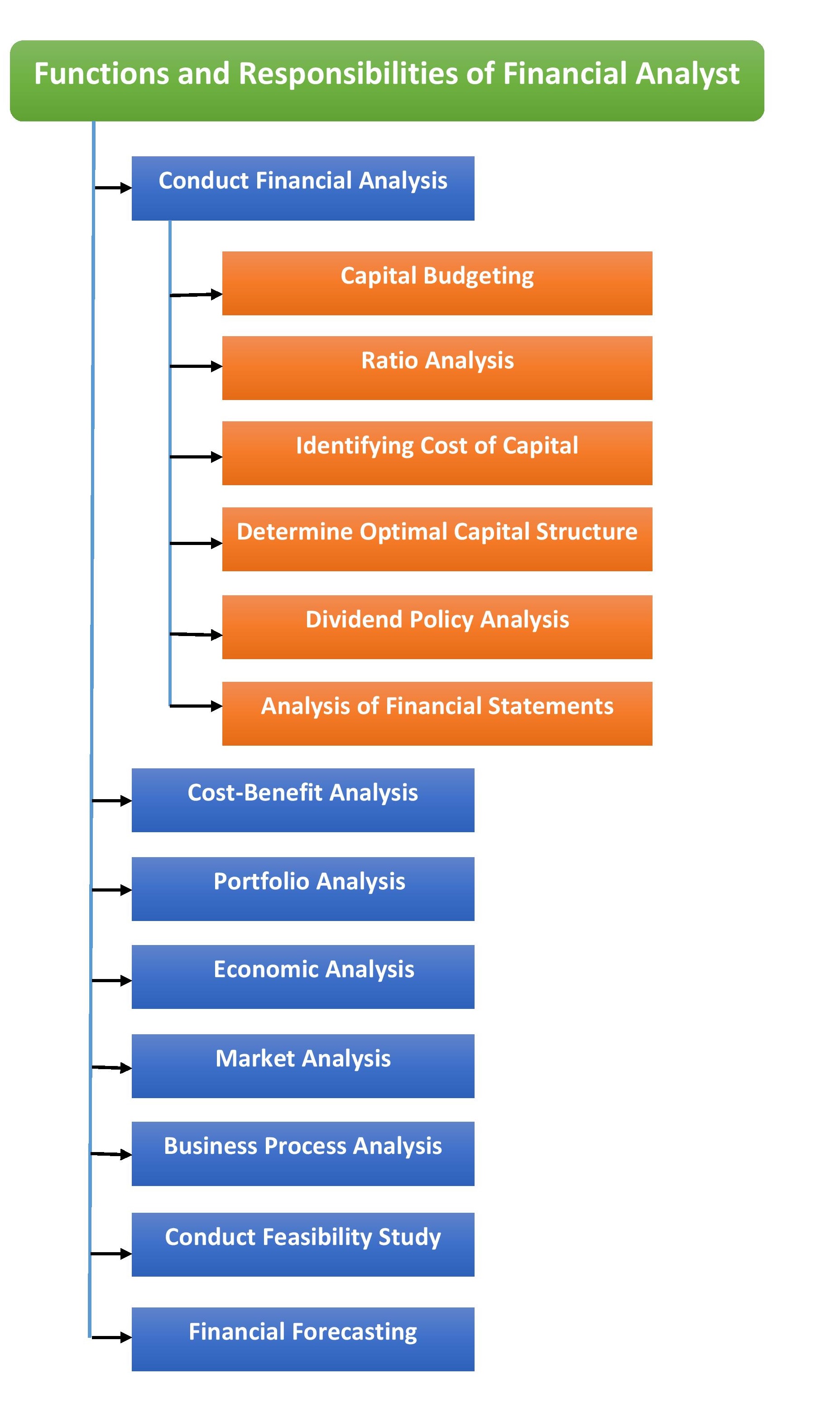

Answering this question will also answer the question of what are the responsibilities and functions of an FA and how they perform. Actually, financial analysts do

- Conduct Financial Analysis

- Capital Budgeting and decision making

- Ratio Analysis

- Identifying Cost of Capital

- Determine Optimal Capital Structure

- Dividend Policy Analysis

- Analysis of Financial Statements

- Financial Forecasting

- Cost-Benefit Analysis

- Portfolio Analysis

- Economic Analysis

- Market Analysis (Capital Market Analysis)

- Business Process Analysis

- Conduct a Feasibility Study

Responsibilities and Functions of the Financial Analyst

Conduct Financial Analysis

The main job of a financial analyst is to do financial analysis, where the analyst can work for an individual, company, or any other business organization. It is a broad category of analysis where many types of analysis are included. As per the instruction and the requirement of the management, the analyst does their work. As a part of the analytical job, analysts actually do the followings:

Capital Budgeting

Investment opportunities for long-term are analyzed by the financial analyst so that the organization can select the most beneficial investment where NPV, IRR indicates a positive outcome.

Ratio Analysis

Ratio analysis is basically done for evaluating the company’s performance, asset, and liability position. Based on the analysis of financial analyst, top management take required important decision for their organization.

Evaluate Cost of Capital

First calculates the cost of capital and then decide which financing decision is optimal for minimizing the cost of capital. Lower the cost of capital means lower cost of collected funds and which helps to higher the return.

Optimal Capital Structure

An analyst also works for determining what should be the optimal capital structure for a particular company and how they can get the benefit of an optimal amount of capital.

Effective Dividend Policy

Effective dividend policy can improve the company’s financial position and a financial analyst do the required analysis and suggest what type of dividend policy that a company may go for.

Analysis of Financial Statements

You know financial statements are the key statements where we can evaluate both the performance and financial position of a company. It is his responsibility to analyze financial statements and report to the management.

Financial Forecasting

It is one of the core functions and responsibilities of a FA. Because financial forecasting will guide a company where to move in the future. And forecasting basically done with the existing data, so proper analysis of data is done by the financial analyst. An effective and efficient financial analyst work as a key factor in minimizing future loss and maximizing benefits.

Cost-Benefit Analysis

A business always needs to choose from different options. And from the available options, it is FA responsibility to conduct a cost-benefit analysis. From the result of cost-benefit analysis make or buy decision can be made and invest or not invest in a particular sector is also decide.

Portfolio Analysis

If a business is dealing with multiple businesses then he/she needs to analyze all of his/her business and its products so that they can decide which combination will give then minimum risk with maximum return. Analysis of the portfolio is also conducted by the financial analyst because the analyst knows how to analyze a portfolio.

Economic Analysis

Here economic analysis includes both micro and macroeconomic analysis where different factors are continuously monitored and analyzed so that if there is any change in influencing factors then a FA can inform and suggest to take a required decision.

Market Analysis

An analyst also works with market analysis, the reason behind is to monitor market share, competitors’ situation so that it would be possible to make a strategic move to become successful in a particular industry.

Business Process Analysis

Business process analysis is one of the critical jobs of any person. Although everyone can not analyze the business process because here critical thinking and proper understanding are required. I believe that an FA can work for a business process analysis because he used to involve the key analysis of the business.

Conduct a Feasibility Study

An experienced financial analyst can do the feasibility study for any industry because he has the capabilities, compassion to conduct a comprehensive feasibility study and make a report where all the functions of FA are applicable for doing a feasibility study.

Is there any Demand for Financial Analyst?

Yes, there is a huge demand for financial analysts in different industries. You may find, the demand of financial analysts is most for the investment bank, capital market, financial institution, bank, non-bank financial institutions, etc. that is for company/organization who do a business of money or financial assets, an analyst is must for them. Nowadays every company tries to keep at least one financial analyst for their organization. So there is no question that there is an increase in demand for a financial analyst. Companies recruiting FA because they are helpful for identifying different success factors.

What are the Educational Qualifications Required to become a Financial Analyst?

To become a financial analyst, first of all, you required to have at least one finance degree, it can be graduation. It is not necessary to have post-graduation as in your graduation you will have enough scope of learning core concepts of finance and financial analysis. You may find that many people are working as an FA but they do not have any finance degree. They actually do their graduation in a business major in accounting but they have the minimum level of knowledge of financial analysis. But if you have a finance degree then it will give you an extra edge to perform financial analysis efficiently.

Educational Qualifications of Financial Analyst

- At least one Bachelor Degree (BBA) concentration in Finance, Finance & Banking, Accounting,

- Post Graduation (MBA) Major in Finance (will add value)

- CFA – Chartered Financial Analyst (will add value); CFA is the most attractive degree accepted worldwide for the FA

- CIMA – Chartered Institute of Management Accountants (will add value)

Why your company should have at least one analyst?

Your company should have at least one analyst because a financial analyst can help you to make the right investment decision. He can help you to do your business in the most cost-effective way which will bring you maximum profit for your company. Every time he will analyze the cost-benefit analysis of your business process and business alternatives. You know business is all about making money, so if you want to make a maximum return from your investment and take the right financial decision then you must have a good FA who will guide you all the time and works as a supporting partner of whom you can trust.

Finally, financial analysts do so many things for a company and they are capable of doing. But it is a management choice of how they utilize a FA for taking the right decision for their company. The challenging job for the recruiter to recruit the best suitable FA from the competitive market.

What does a Financial Analyst do pdf

Written by