When it comes to managing your business finances efficiently, one of the smartest steps you can take is understanding your loan repayment structure before applying. Whether you’re expanding your business, upgrading equipment, or managing working capital, knowing your monthly obligations helps you plan better. That’s where using a term loan EMI calculator can make a big difference. This simple yet powerful tool allows entrepreneurs to estimate monthly payments, assess affordability, and make informed borrowing decisions — all within minutes.

A business loan is one of the most flexible financing options available to small and medium enterprises. It provides the funds you need to maintain cash flow, hire new staff, or invest in infrastructure without exhausting your reserves. But before applying, it’s essential to understand how much you’ll need to repay every month and how interest will impact your overall budget. Using a term loan EMI calculator on FlexiLoans.com helps you clearly visualize your repayment plan and align it with your expected revenue.

Why Every Business Owner Should Use an EMI Calculator

Financial planning is crucial for the success of any business, and loan repayment is a major part of that process. The term loan EMI calculator offered by FlexiLoans simplifies complex loan mathematics, allowing you to instantly know your EMI amount based on the loan tenure, interest rate, and principal amount. This transparency ensures there are no surprises later when your monthly repayment cycle begins.

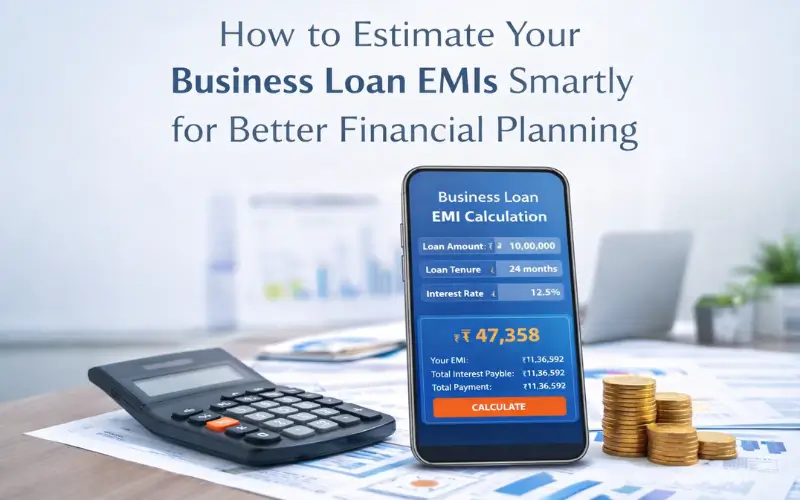

For example, if you’re considering a loan of ₹10 lakh for business expansion, you can use the calculator to see how different tenures — say, 12, 24, or 36 months — will affect your monthly EMIs. This helps you choose a repayment plan that keeps your business financially stable while still meeting growth targets.

Benefits of Using FlexiLoans’ Term Loan EMI Calculator

1. Instant and Accurate Results

Gone are the days of manual calculations or confusing spreadsheets. The FlexiLoans calculator gives you instant, precise EMI estimates in seconds, helping you save time and avoid human error.

2. Better Financial Planning

With clear EMI data, you can forecast monthly expenses and plan cash flow effectively. Knowing your fixed outflow helps maintain working capital and ensures that you never miss a payment.

3. Comparison Made Easy

Before finalizing your loan, you can compare different loan amounts and tenures. This flexibility lets you evaluate which repayment schedule best fits your financial goals and comfort level.

4. Transparency and Control

FlexiLoans’ calculator ensures complete transparency — you’ll know exactly how much you’re paying in principal and interest throughout the loan term. That clarity helps you borrow confidently.

Why Choose FlexiLoans for Your Business Loan?

When it comes to financing growth, FlexiLoans stands out as one of India’s most trusted digital lenders for MSMEs. The company offers business loans with minimal documentation, fast approvals, and flexible repayment tenures. Whether you’re a retailer, manufacturer, or service provider, FlexiLoans provides customized solutions that cater to your specific business needs.

Here’s why thousands of entrepreneurs prefer FlexiLoans:

- Quick online application and disbursal process

- Loans up to ₹50 lakh without collateral

- Flexible repayment options designed for small business cash cycles

- Transparent fee structure with no hidden charges

- Dedicated support team for guidance throughout the loan journey

By combining technology with financial expertise, FlexiLoans ensures that accessing capital is no longer a hurdle for ambitious entrepreneurs.

How to Use the Term Loan EMI Calculator

Using the FlexiLoans EMI calculator is effortless:

- Visit the Term Loan EMI Calculator page.

- Enter your desired loan amount.

- Select your preferred tenure and interest rate.

- Instantly view your monthly EMI, total interest payable, and total payment amount.

The calculator allows you to tweak values as many times as you like until you find the repayment plan that perfectly aligns with your financial comfort.

Final Thoughts

Accurate EMI estimation is the foundation of smart borrowing. Before applying for a business loan, take a few minutes to explore your repayment options using the term loan EMI calculator from FlexiLoans. It’s a simple step that can save you financial stress down the line and help you borrow with clarity and confidence.

With FlexiLoans, your business growth is never out of reach — just well-planned