The Financial System is a systematic organization of institutions through which surplus units (those have a surplus amount of funds) transfer their fund to deficit units (those need funds to be financed) so that both the parties surplus and deficit unit get the financial benefit. Financial institutions or other individual financial companies use different kinds of financial instruments to transfer funds according to their needs. Sometimes people or institutions collect funds directly from direct sources and sometimes they collect with the help of financial intermediaries.

The flow of funds can be possible through the following ways

- The direct transfer of funds directly from the surplus unit (those have extra funds) to deficit units (those need additional funds).

- Indirect transfer facilitates the flow of funds with the help of financial intermediaries or investment bankers or investment through a mutual fund is the way of indirect transfer of funds.

The Financial System of Bangladesh consists of the Followings

Financial Institutions

The financial institution deals with a financial transaction where both bank and non-bank financial institutions (leasing companies, insurance companies). There are 58 banking institutions are in Bangladesh which is owned by the state, private, public, foreign companies and there are 34 non-banking financial institutions in our country. Both bank and non-bank financial institutions ensuring cost-effective transactions and flow of funds.

Financial Markets

Financial Markets are consist of a money market and capital market, where the money market deals with a short-term investment like Treasury bill, certificate of deposit, short-term government bond (risk-free investment). On the other hand, the capital market deals with long-term financial instruments (stock, bond, debenture, etc.)

Financial Instruments

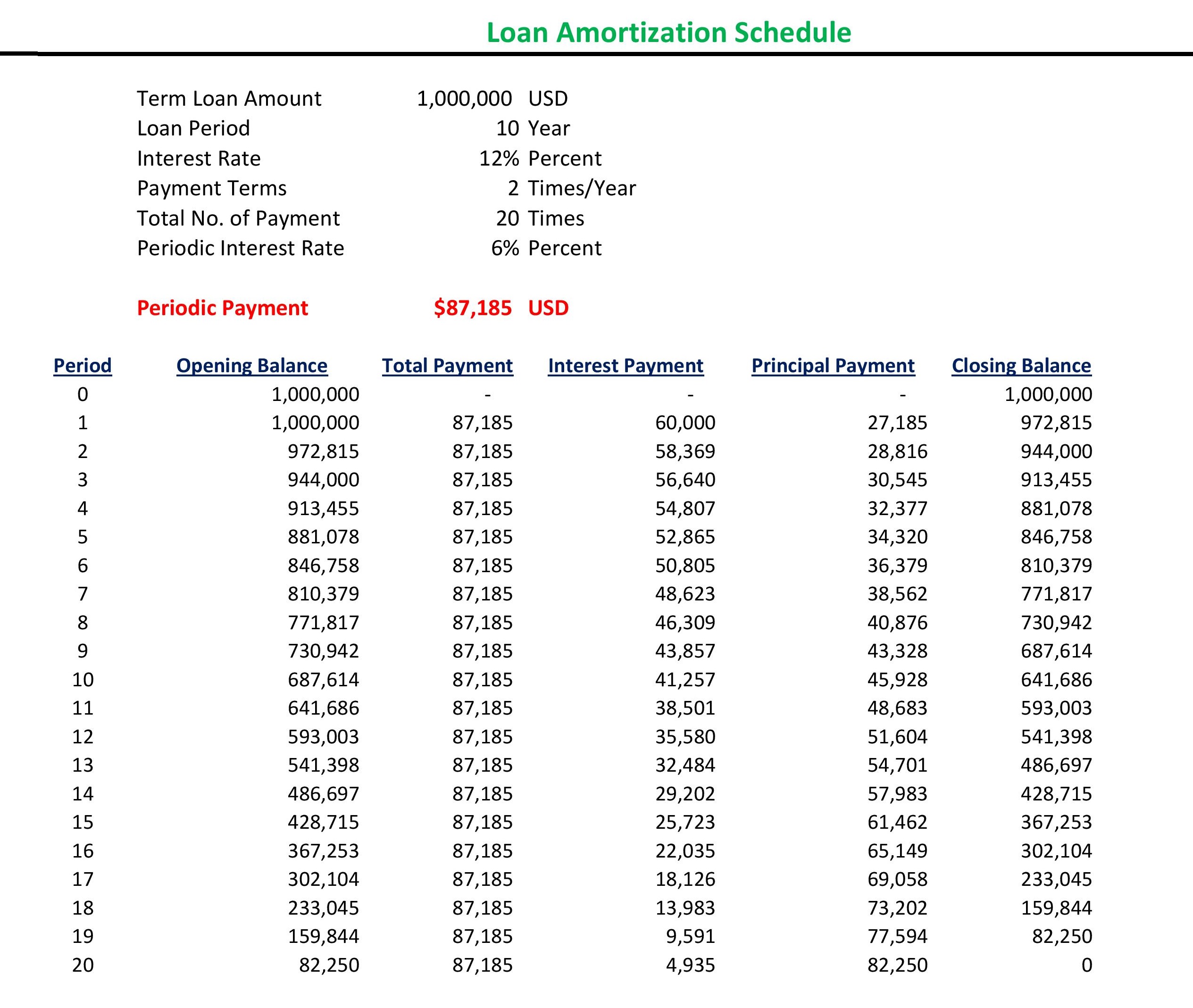

Financial Instruments are used to make transactions or investments which can be for the long term or short term. According to the demand of the market different financial institution offers different financial product so that required lending and borrowing can be possible.

Written by