Determining Financing Needs for Business

The success of a business depends on the effective use of financial and non-financial resources. It is the financial manager’s responsibility for determining financial needs for business and to ensure the right borrowing and financing decision. Holding an optimum level of funds is not an easy task. Every manager has to go through a systematic process to decide how much money should be kept on hand as cash and identify whether there is sufficient money to continue business operations. Also, the financial manager has to identify whether to make financing and investing decisions.

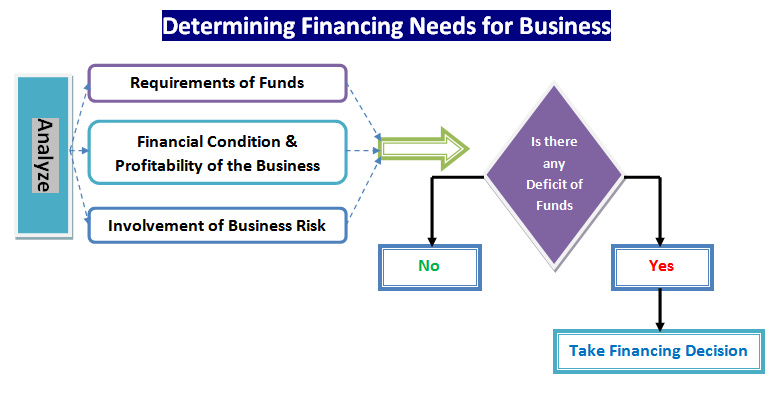

Before taking any financing decision for business first of all it is required to analyze some factors and on the basis of this, it is possible to identify whether there is a deficit or surplus of funds. If there is a deficit of funds then it is required to take a financing decision.

Three things need to be analyzed when determining financing needs for business these are

Requirements of Funds

Requirements of Funds

First of all, it is required to check how much fund is required for the business over a period of time. This can be estimated through forecasting or trend analysis. Remember the requirements of funds depend upon the type of business, collection policy of accounts receivables, and business operations.

Identify the Profitability of the Business

After analyzing the requirement of funds the financial condition of business for a particular date should be measured where the asset and liability position can be seen. In addition to this, the profitability of the business also required to be checked. If the profitability is high then there will be more funds to spend and the owner of the business will eager to spend more as he is getting more profit.

Risk Involved with Business

Here we consider the business risk which arises when a business is unable to generate sufficient revenue by using its resources to compensate its operating expenditures. If a business risk is high then it is needed to acquire funds through financing.

A financial manager must consider all these three together to determine whether he/she will finance funds for the business or not. According to the nature of the requirement, the financing can be short term or long term. It is obvious to finance short-term requirements from short-term sources and long-term from a long-term source of funds.

Written by

the right borrowing and financing decision. Holding an optimum level of funds is not an easy task. Every manager has to go through a systematic process to decide how much money should be kept on hand as cash and identify whether there is sufficient money to continue business operations. Also, the financial manager has to identify whether to make financing and investing decision.

Thanks