You may have a question in your mind that is it possible to minimize systematic risk? If you have then I am right here with your answer. After reading this hope you will understand what actually systematic risk is, what are the factors related to this and is there any way to minimize systematic risk or not.

Is It Possible to Minimize Systematic Risk?

First of all, let me explain the meaning of systematic risk. The risk associated with macroeconomic factors like; market interest rate, inflation, the rate of unemployment, economic recession, oil price, etc. are the source of systematic risk. These factors cannot be changed or influenced by individuals or organizations. Normally risk which cannot be minimized through diversification of investment is considered as a systematic risk. In another sense risk which is beyond the control of individuals or organizations is a systematic risk.

Minimizing risk is possible only through investing in negatively correlated financial securities. Here negatively correlated means the return of an individual security is not directly related to the return of other securities.

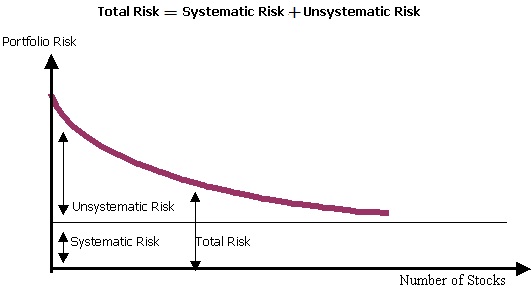

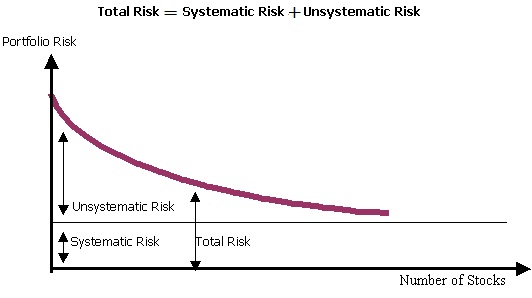

The main thing is, through diversification only we can minimize the unsystematic risk portion which is arisen from the microeconomic factors. Because microeconomic factors can be controlled by individuals or organizations by taking a proper economic decision. So at this point, we basically can say the unsystematic risk is a controllable and systematic risk is out of control, but the question is why systematic risk is out of control?

The influencing factors of systematic risk come from macroeconomic sources which are beyond our control. As individuals we do not have control over the unemployment rate of our country, we cannot reduce or control the inflation rate, we cannot fix the oil price, we cannot change the market interest rate, we cannot improve our unexpected economic recession situation by our own. Only the proper economic policy taken by the government can influence/ change or control these factors. That’s why as an individual’s we cannot minimize systematic risk.

It is not necessary that the percent of systematic risk always remains fixed. It can vary according to the change of economic condition. When there is a recession, more systematic risk will be there. For an economic boom situation, the market provides more income, ensures less unemployment. And for these, there will have less systematic risk.

Beta is the measure of Systematic Risk, which is the function of macroeconomic factors. We can calculate systematic risk by:

Systematic Risk (Beta) = Covariance between Individual Securities & Market/ Variance of Market

You know that a market beta (Systematic Risk) is always 1. If your investment (Securities) beta is less than 1 then your investment is more stable (less systematic risk) than the market. On the other hand if your investment (Securities) beta is more than 1 then your investment will more unstable (more systematic risk) compared with the market.

At the end of this brief explanations, we can say that it is not possible to minimize the systematic risk. So it would be a wise decision to work for minimizing unsystematic risk through diversifying your investment and try to make an optimal portfolio.

If you like this article then please leave your comment, or if you have any confusion about this topic then let me know.

Written by: Md. Nahian Mahmud Shaikat

Financial Analyst

Mail: [email protected]