The foreign exchange market, also known as the forex market, is a worldwide exchange platform that offers traders worldwide, including South African investors, a great way to get involved in global financial markets. Timing is an important component of effective forex trading. Understanding the best times to trade can significantly impact trading outcomes. In this article, we’ll look at market liquidity, volatility, and important currency pairs as we examine the best times to trade forex in South Africa.

Understanding Forex Market Sessions:

The forex market operates 24 hours a day, five days a week, thanks to the overlapping sessions of major financial centres, making it essential to develop the best forex trading strategy and survive the dreadful market. These sessions include:

- Asian Session: Known for its Tokyo market, which opens at 23:00 GMT and runs concurrently with the Sydney session.

- European Session: Led by London, it starts at 7:00 GMT and briefly overlaps with the Asian session.

- North American Session: Driven by New York, starting at 12:00 GMT and overlapping with both the European and Asian sessions.

Best Times for Trading in South Africa:

Given South Africa’s time zone (UTC+2), traders can align their activities with specific forex market sessions for optimal results.

Key points to consider:

1. Overlap of Sessions:

When significant sessions overlap, trading chances are at their finest. Increased liquidity and volatility are common during the overlap of the European and North American sessions (13:00 to 17:00 SAST) for traders in South Africa.

2. Avoiding Low-Liquidity Periods:

Trading during the early Asian session or the late North American session may result in lower liquidity and wider spreads, potentially increasing the risk of slippage.

3. Currency Pairs and Volatility:

During particular sessions, there is a variation in the volatility of different currency pairs. There is usually more activity in major pairs, such as EUR/USD, GBP/USD, and USD/JPY, during the European and North American sessions.

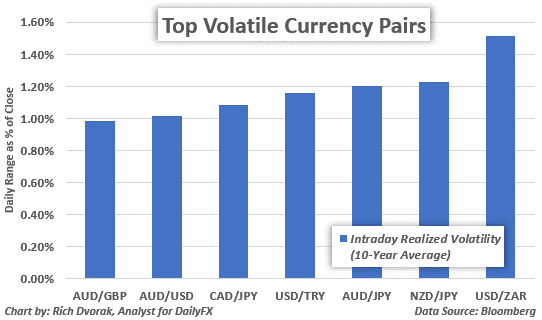

Consider the following chart:

Top Volatile Currency Pairs | Source: Rich Dvorak Via DailyFX

This chart visually represents the volatility of major currency pairs across different trading sessions, aiding traders in selecting the most suitable times for specific pairs.

4. Economic Calendar and News Events:

South African traders should also be aware of major economic events and news releases that can significantly impact currency markets. Referring to an economic calendar, such as the one below, can help in planning trades around these events:

| Date | Time (SAST) | Event | Impact |

| 2023-01-15 | 14:00 | Non-Farm Payrolls | High |

| 2023-02-02 | 09:30 | Interest Rate Decision | Medium |

N.B.: This is an example and should not be taken verbatim.

Conclusion:

Careful analysis of market sessions, currency pair volatility, and economic events is necessary for successful forex trading in South Africa. Trading operations can be coordinated with the best periods to increase the likelihood that traders will make wise choices and realise their full potential for profit. Finding successful forex trading methods can be aided by the use of charts, tables, economic calendars, and botogon robot trading. Recall that in the world of forex trading, risk management is crucial and that no technique can ensure success.