Running a small business means juggling countless responsibilities, but there’s one area where you simply can’t afford to drop the ball: financial management. The difference between a thriving enterprise and one that’s barely scraping by often comes down to how well you handle the money side of things. Here’s what happens all too often, business owners pour their energy into sales and daily operations while treating financial planning like something they’ll get to “eventually. ” This approach? It’s a recipe for cash flow headaches and missed growth opportunities.

Build and Maintain a Detailed Cash Flow Forecast

Think of cash flow management as your business’s circulatory system, without healthy flow, nothing else functions properly. A comprehensive cash flow forecast isn’t just a nice-to-have document; it’s your early warning system for financial trouble ahead. By projecting your income and expenses monthly for at least six to twelve months out, you’re accounting for those seasonal ups and downs that every business experiences. This forward-thinking approach gives you something invaluable: time.

Separate Personal and Business Finances Completely

Here’s a financial fundamental that too many entrepreneurs ignore: keeping personal and business finances completely separate. It sounds simple, yet you’d be surprised how many business owners still pay for business expenses with their personal card or vice versa. Opening dedicated business bank accounts and getting a business credit card creates crystal-clear boundaries that make your accountant’s job easier and your tax preparation far less stressful. This separation does more than simplify bookkeeping, it protects your personal assets from business liabilities and establishes your company as a credible entity when you’re dealing with lenders, vendors, or potential investors.

Implement Regular Financial Reviews and Benchmarking

Generating financial reports and actually understanding what they’re telling you are two completely different things. Successful business owners schedule monthly financial reviews that create accountability and keep them plugged into their company’s financial reality rather than living in the dark until disaster strikes. During these sessions, you’re comparing actual performance against what you budgeted, spotting variances, and digging into why the numbers aren’t matching your expectations. Taking it a step further, benchmarking your metrics against industry standards gives you context, are you doing great, or does it just feel that way because you don’t know how competitors are performing? Keep your eye on metrics like gross profit margin, operating expense ratio, current ratio, and how much you’re spending to acquire customers relative to their lifetime value.

Optimize Your Pricing Strategy Based on True Costs

Want to know a common way small businesses sabotage their own success? They undercharge for their products or services because they haven’t calculated their true costs. Conducting a thorough analysis of your complete cost structure, direct costs, overhead, and yes, the actual value of your time, ensures your pricing actually supports healthy margins instead of slowly bleeding you dry. Value-based pricing is worth exploring here; it focuses on the outcomes you deliver to customers rather than just slapping a percentage markup on your costs and hoping for the best. Markets change, costs rise, and your offerings improve over time, which is why regular pricing reviews matter.

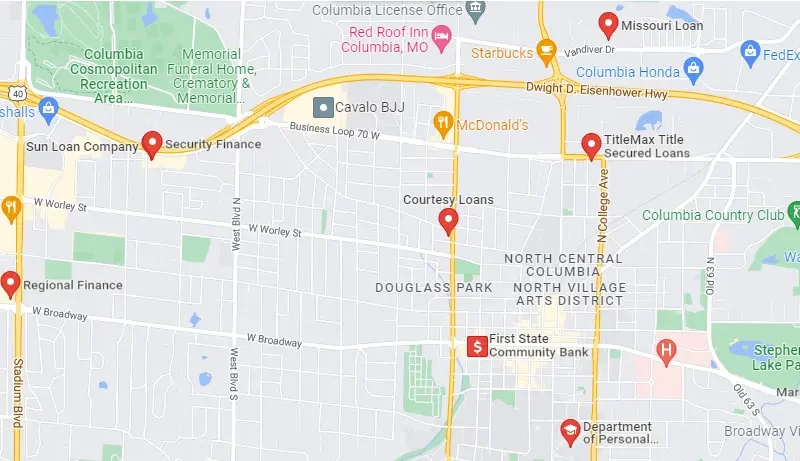

Establish Multiple Funding Sources and Credit Relationships

Putting all your funding eggs in one basket? That’s a risky move that limits your flexibility when opportunities knock or challenges arise unexpectedly. Diversifying your funding sources, think traditional bank relationships, alternative lenders, investors, and good old-fashioned retained earnings, gives you options when you need capital and can’t afford to wait around. Building relationships with lenders before you’re desperately scrambling for money puts you in a much stronger negotiating position and dramatically improves your chances of approval when you finally do apply. Maintaining a solid business credit profile by paying suppliers promptly, keeping credit utilization reasonable, and monitoring your business credit reports opens doors to better terms and higher credit limits down the road. When you’re planning expansion or equipment purchases, many business owners turn to small business term loans that offer predictable repayment schedules and competitive rates. Having pre-approved credit lines sitting there provides a safety net for unexpected expenses or opportunities that demand quick action. Remember this: the best time to secure funding is when you don’t desperately need it, because desperation weakens your negotiating position and shrinks your options considerably.

Automate Financial Processes to Reduce Errors and Save Time

Technology has completely transformed how small businesses handle their finances, putting sophisticated tools within reach of companies that don’t have entire finance departments on staff. Implementing accounting software that automates invoicing, expense tracking, and financial reporting cuts down on manual errors while freeing up your time for strategic thinking instead of data entry drudgery. Automated payment systems ensure bills get paid on time without you having to remember each one, avoiding late fees and keeping vendor relationships strong. Digital receipt capture and automatic expense categorization eliminate that chaotic shoebox of receipts that makes tax season a nightmare and causes you to miss legitimate deductions.

Build and Protect Your Emergency Reserve Fund

Financial resilience doesn’t come from hoping for the best, it comes from preparing for the worst. Establishing an emergency fund equivalent to three to six months of operating expenses creates a crucial cushion against revenue disruptions, surprise expenses, or broader economic downturns that could otherwise sink your ship. This reserve should sit in easily accessible accounts that are separate from your operating funds, clearly marked for emergency use only so you’re not tempted to dip into it for non-emergencies. Building this fund takes real discipline, especially during growth phases when every dollar feels like it should be reinvested immediately, but the peace of mind and stability it provides are absolutely priceless.

Conclusion

Putting these seven finance tips into practice creates the kind of solid foundation that supports sustainable growth and helps your business weather whatever economic storms come your way. Sound financial management doesn’t just happen, it demands intentional practices, consistent attention, and a willingness to make decisions based on data rather than gut feelings alone. By building strong cash flow forecasting habits, keeping your finances properly separated, conducting regular financial reviews, optimizing your pricing strategy, diversifying your funding sources, embracing automation, and establishing emergency reserves, you’re setting your business up to seize opportunities while successfully navigating the inevitable challenges ahead. The effort you invest in strengthening your financial management pays real dividends through reduced stress, improved profitability, and genuine confidence in where your business is headed.