If you’re a small business owner, you know that managing payroll can be a challenging task. QuickBooks Payroll is a popular solution, but it’s not the only option available. In this blog post, we’ll explore eight of the best alternatives to QuickBooks Payroll, offering features that might better suit your business needs. Whether you’re looking for more flexibility, better pricing, or enhanced features, these alternatives provide robust options to streamline your payroll processes.

1. ZarMoney

ZarMoney is a powerful accounting and payroll software designed to meet the needs of small to medium-sized businesses. Known for its user-friendly interface and robust features, ZarMoney helps businesses manage their finances efficiently. Here’s an in-depth look at what ZarMoney offers:

Features of ZarMoney

- Comprehensive Payroll Management.

- Invoicing

- Expense Tracking

- Inventory Management

- Bank Reconciliation

- Reporting and Analytics

- Multi-User Access

- Customer Relationship Management (CRM)

- Time Tracking

- Cloud-Based Access

Top 3 Features of ZarMoney

- Comprehensive Payroll Management:

Explanation: ZarMoney’s payroll management feature automates the entire payroll process, reducing errors and ensuring compliance with tax regulations.

- Invoicing:

Explanation: With ZarMoney, you can create and send customized invoices, making it easy to manage billing and payments efficiently.

- Expense Tracking:

Explanation: The expense tracking feature helps you monitor all business expenses, providing a clear view of your financial health.

Pros of ZarMoney

- User-Friendly Interface

- Comprehensive Features

- Cloud-Based Access

- Affordable Pricing

Cons of ZarMoney

- Learning Curve

- Limited Integrations

- Customer Support

Pricing

ZarMoney offers flexible pricing plans designed to fit the needs of different business sizes. The pricing starts at $15 per user per month, which includes access to all features and unlimited transactions. For businesses with more complex needs, ZarMoney offers custom pricing plans tailored to specific requirements.

Final Verdict

ZarMoney stands out as a comprehensive accounting and payroll solution for small to medium-sized businesses. Its wide range of features, user-friendly interface, and competitive pricing make it a strong alternative to QuickBooks Payroll. While there is a learning curve and some limitations in integrations, the overall value provided by ZarMoney makes it a worthy consideration for businesses looking to streamline their payroll and accounting processes.

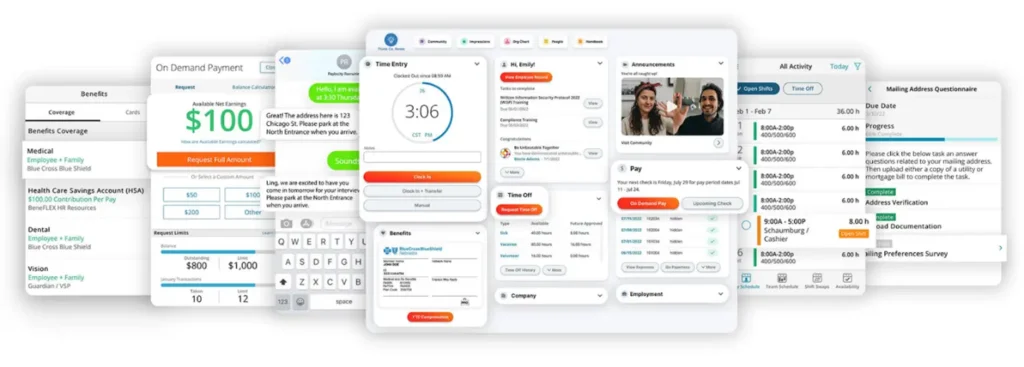

2. Paylocity

Paylocity is a comprehensive payroll and HR software designed to streamline various administrative tasks for businesses of all sizes. Known for its user-friendly interface and robust feature set, Paylocity offers a range of solutions that go beyond just payroll processing, making it a valuable tool for managing your workforce efficiently.

Features

- Automated Payroll Processing

- Tax Filing Services

- Direct Deposit

- Employee Self-Service Portal

- Time and Attendance Tracking

- Benefits Administration

- Onboarding Tools

- Compliance Management

- Mobile Access

- Customizable Reporting

Top 3 Features

- Automated Payroll Processing:

Paylocity automates the entire payroll process, ensuring accurate and timely payments to employees, which reduces the risk of errors and saves time.

- Employee Self-Service Portal:

This feature allows employees to access their payroll information, benefits, and other HR-related documents online, enhancing transparency and reducing administrative burden.

- Customizable Reporting:

Paylocity offers extensive reporting capabilities, allowing businesses to generate customized reports to gain insights into various HR metrics and make informed decisions.

Pros

- User-friendly interface

- Extensive feature set beyond payroll

- Strong customer support

- Comprehensive compliance management

Cons

- Higher cost compared to some competitors

- May have a learning curve for new users

Pricing

Paylocity offers customized pricing based on the specific needs and size of your business. They typically provide a quote after understanding your requirements, making it essential to contact them directly for detailed pricing information.

Final Verdict

Paylocity is a powerful and versatile payroll and HR software solution that offers a wide range of features to meet the diverse needs of businesses. While it may come at a higher price point, the comprehensive functionality and excellent customer support make it a worthwhile investment for companies looking to streamline their payroll and HR processes. If you value a robust feature set and are willing to invest in a premium solution, Paylocity is an excellent alternative to QuickBooks Payroll.

3. Wagepoint

Wagepoint is a user-friendly payroll software designed to simplify payroll processes for small and medium-sized businesses. Known for its ease of use and comprehensive features, Wagepoint helps businesses manage employee payments, taxes, and compliance efficiently. It offers a range of tools to streamline payroll tasks, ensuring accuracy and compliance with federal and state regulations.

Features of Wagepoint

- Direct Deposit

- Payroll Tax Filing

- Employee Self-Service Portal

- Compliance Management

- Automated Year-End Reporting

- Time Tracking Integration

- Benefits Management

- Garnishment Processing

- Multi-State Payroll

- Customer Support

Top 3 Features with Explanations

- Direct Deposit:

Wagepoint’s direct deposit feature ensures timely and secure payment to employees’ bank accounts, reducing the hassle of issuing paper checks.

- Payroll Tax Filing:

This feature automatically calculates and files payroll taxes, helping businesses stay compliant with tax regulations and avoid penalties.

- Employee Self-Service Portal:

The self-service portal empowers employees to access their pay stubs and tax forms online, reducing the administrative burden on HR departments.

Pros of Wagepoint

- Easy to use interface, suitable for small and medium-sized businesses.

- Comprehensive tax filing and compliance features.

- Excellent customer support through multiple channels.

Cons of Wagepoint

- Limited advanced features for larger enterprises.

- Integration options with other software can be limited.

- Higher pricing compared to some competitors.

Pricing

Wagepoint offers a straightforward pricing model starting at $20 per pay period plus $2 per employee. There is also a monthly base fee of $20, which makes it affordable for small businesses with few employees but can become expensive as the number of employees increases.

Final Verdict

Wagepoint is a robust and user-friendly payroll solution ideal for small and medium-sized businesses looking for an efficient way to manage payroll. Its comprehensive tax filing features, direct deposit capabilities, and employee self-service portal make it a strong contender. However, larger enterprises or businesses looking for extensive integration options might find it somewhat limited. Despite this, Wagepoint’s ease of use and reliable customer support make it a worthy alternative to QuickBooks Payroll.

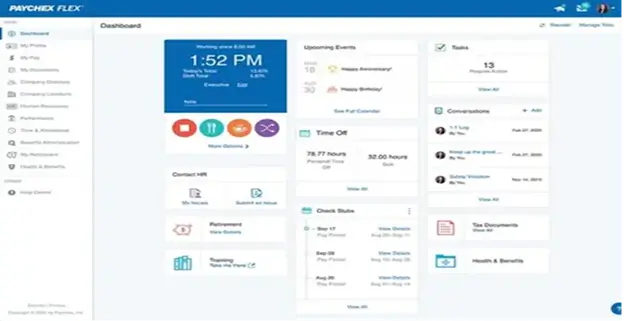

4. Paychex Flex

Paychex Flex is a comprehensive payroll and HR solution designed to cater to businesses of all sizes. It offers a range of services including payroll processing, benefits administration, HR management, and compliance support. Known for its user-friendly interface and robust features, Paychex Flex helps businesses streamline their payroll and HR operations, ensuring accuracy and efficiency.

Key Features of Paychex Flex

- Payroll Processing

- Employee Self-Service

- Time and Attendance Tracking

- Tax Filing Services

- HR Management

- Mobile App

- Customizable Reports

- Benefits Administration

- Compliance Support

- Integration Capabilities

Top 3 Features

- Payroll Processing:

Paychex Flex simplifies payroll management with automated processes, ensuring accurate and timely payments to employees. Its robust tax calculation and filing services minimize the risk of errors and penalties.

- Employee Self-Service:

This feature empowers employees to access and manage their payroll and personal information independently. It reduces administrative workload and enhances employee satisfaction by providing easy access to essential documents.

- Time and Attendance Tracking:

The integrated tools for tracking employee hours and managing time-off requests help businesses maintain accurate records, improve scheduling, and ensure compliance with labor laws.

Pros

- User-friendly interface

- Comprehensive payroll and HR features

- Strong customer support

- Extensive integration capabilities

- Mobile app for on-the-go access

Cons

- Pricing can be high for small businesses

- Limited customization options

- Learning curve for some advanced features

Pricing

Paychex Flex offers various pricing plans based on the size and needs of the business. Pricing typically starts at $60 per month plus $4 per employee. Custom quotes are available for larger organizations or those with specific requirements.

Final Verdict

Paychex Flex is a robust and reliable payroll and HR solution suitable for businesses of all sizes. Its comprehensive features, user-friendly interface, and strong customer support make it an excellent alternative to QuickBooks Payroll. However, the pricing may be a consideration for smaller businesses, and some users may find the learning curve for advanced features challenging. Overall, Paychex Flex stands out as a powerful tool to streamline payroll and HR operations, ensuring efficiency and compliance.

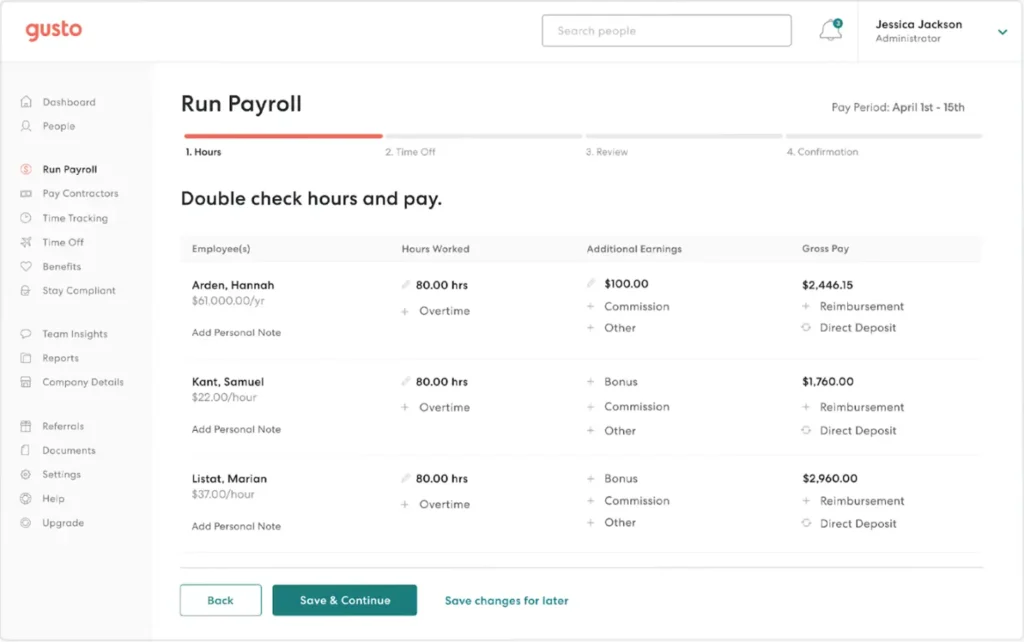

5. Gusto

Gusto is a well-regarded payroll software that simplifies and streamlines payroll processes for small and medium-sized businesses. It offers a wide range of features designed to handle payroll, benefits, and human resources with ease. Gusto is known for its user-friendly interface and robust support, making it a popular choice for businesses looking for an efficient and effective payroll solution.

Key Features:

- Automatic Payroll

- Employee Self-Service

- Direct Deposit

- Benefits Administration

- Time Tracking

- Compliance Management

- Onboarding Tools

- PTO Management

- Customizable Reports

- Mobile Access

Top 3 Features:

- Automatic Payroll:

Gusto’s automatic payroll feature eliminates the need for manual processing, ensuring timely and accurate payroll runs without hassle.

- Employee Self-Service Portal:

The self-service portal empowers employees to manage their own information, reducing administrative workload for HR departments.

- Benefits Administration:

Comprehensive benefits administration capabilities make it easy to manage employee benefits, enhancing overall employee satisfaction and retention.

Pros:

- User-Friendly Interface

- Comprehensive Features

- Excellent Customer Support

Cons:

- Limited International Support

- Pricing

- Learning Curve

Pricing:

Gusto offers several pricing plans to cater to different business needs:

- Core Plan: $39 per month plus $6 per employee per month. Includes basic payroll features and employee self-service.

- Complete Plan: $39 per month plus $12 per employee per month. Adds features such as time tracking, PTO management, and onboarding tools.

- Concierge Plan: $149 per month plus $12 per employee per month. Offers enhanced support and HR resource center access.

Final Verdict:

Gusto stands out as a powerful and user-friendly payroll solution suitable for small and medium-sized businesses. Its extensive feature set, combined with excellent customer support, makes it a top contender in the payroll software market. While it may have a few limitations, such as its higher pricing and focus on the U.S. market, Gusto’s overall value and ease of use make it a worthwhile investment for businesses seeking a reliable payroll solution.

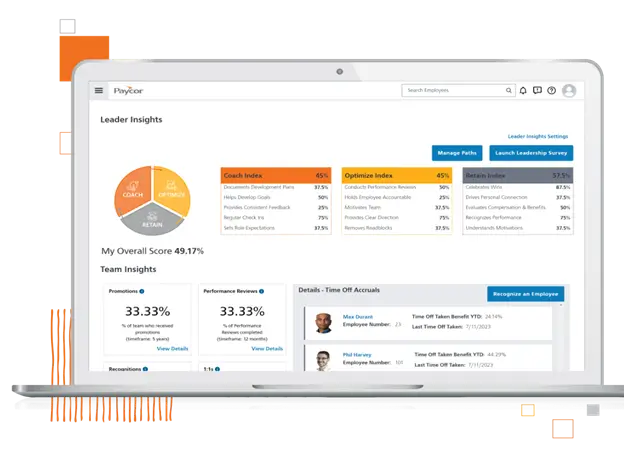

6. Paycor

When it comes to managing payroll, Paycor stands out as a robust and reliable alternative to QuickBooks Payroll. Designed to streamline HR and payroll processes, Paycor offers an all-in-one solution that caters to businesses of various sizes. With its user-friendly interface and extensive features, Paycor ensures that payroll management is both efficient and accurate.

Features of Paycor

- Automated Payroll Processing

- Employee Self-Service Portal

- Time and Attendance Tracking

- Compliance Management

- Customizable Reporting

- Direct Deposit

- Tax Filing Services

- Benefits Administration

- Mobile App

- Onboarding Tools

Top 3 Features of Paycor

- Automated Payroll Processing

Paycor’s automated payroll processing significantly reduces the time and effort required for payroll management. By automating calculations and ensuring accuracy, it minimizes the risk of errors and compliance issues.

- Employee Self-Service Portal

The self-service portal empowers employees to access their pay information, tax documents, and personal details anytime, anywhere. This reduces the administrative burden on HR and increases transparency for employees.

- Compliance Management

Paycor’s compliance management tools ensure that your business stays updated with ever-changing payroll regulations. It automatically adjusts to new laws and regulations, keeping your payroll process compliant and hassle-free.

Pros of Paycor

- User-Friendly Interface

- Comprehensive Features

- Reliable Customer Support

- Scalable Solution

- Mobile Accessibility

Cons of Paycor

- Learning Curve

- Pricing

- Integration Limitations

Pricing

Paycor offers a variety of pricing plans tailored to the size and needs of your business. While specific pricing details are not publicly listed, Paycor typically provides custom quotes based on the number of employees and the specific services required. It’s advisable to contact Paycor directly for a detailed quote that matches your business needs.

Final Verdict

Paycor is an excellent alternative to QuickBooks Payroll, offering a comprehensive suite of payroll and HR tools designed to streamline your business operations. Its automated processes, robust compliance management, and user-friendly interface make it a strong contender for businesses looking to enhance their payroll management. While it may come with a higher price tag, the features and support provided by Paycor justify the investment, particularly for growing businesses seeking a scalable and reliable payroll solution.

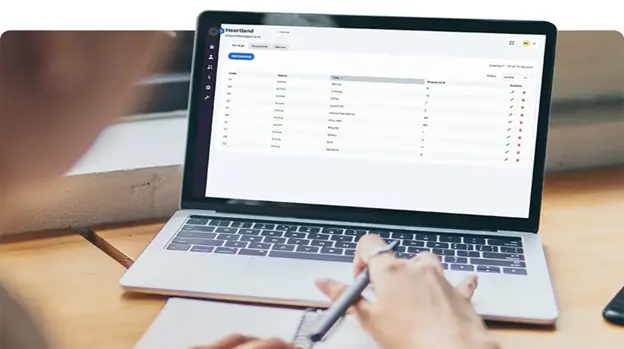

7. Heartland Payroll

When it comes to managing payroll efficiently, Heartland Payroll stands out as a robust and versatile alternative to QuickBooks Payroll. Designed to cater to businesses of all sizes, Heartland Payroll offers a range of features that simplify the payroll process, ensuring accuracy and compliance. Here, we will delve into what makes Heartland Payroll a preferred choice for many businesses, highlighting its key features, pricing, pros, and cons.

Features of Heartland Payroll

- Automated Payroll Processing

- Tax Filing and Compliance

- Direct Deposit

- Employee Self-Service Portal

- Time and Attendance Tracking

- Customizable Reporting

- HR Support

- Benefits Administration

- Mobile Access

- Customer Support

Top 3 Features

- Automated Payroll Processing:

Heartland Payroll automates the entire payroll process, ensuring that all calculations are accurate and payments are made on time. This reduces manual errors and saves significant time.

- Tax Filing and Compliance:

The software handles all aspects of tax filing, ensuring compliance with federal, state, and local regulations. This feature minimizes the risk of costly penalties and simplifies the tax season.

- Employee Self-Service Portal:

The self-service portal allows employees to access their payroll information, view pay stubs, and update personal details, enhancing transparency and reducing administrative workload.

Pros

- User-Friendly Interface

- Comprehensive Features

- Scalability

- Reliable Customer Support

Cons

- Cost

- Learning Curve

Pricing

Heartland Payroll offers customized pricing based on the specific needs and size of the business. Typically, pricing includes a base fee plus a per-employee charge. For an accurate quote, businesses are encouraged to contact Heartland Payroll directly.

Final Verdict

Heartland Payroll is a feature-rich and reliable payroll solution that offers a comprehensive range of tools to manage payroll and HR tasks efficiently. Its automated processes, robust compliance features, and user-friendly interface make it an excellent choice for businesses looking to streamline their payroll operations. While the cost may be higher compared to some alternatives, the benefits and support provided justify the investment, making Heartland Payroll a strong contender in the payroll software market.

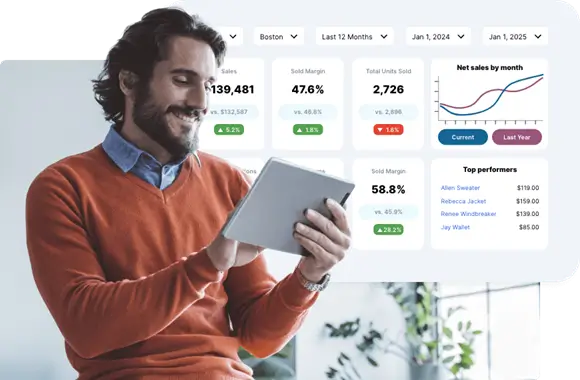

8. Heartland Rippling

Heartland Rippling is a robust and versatile payroll software designed to streamline payroll management for businesses of all sizes. Known for its comprehensive suite of features, Heartland Rippling offers a user-friendly interface that simplifies complex payroll processes. Whether you are a small business owner or managing a large enterprise, Heartland Rippling provides the tools you need to ensure accurate and timely payroll processing.

Features

- Automated Payroll Processing

- Direct Deposit

- Tax Filing Services

- Employee Self-Service Portal

- Time and Attendance Tracking

- Customizable Reports

- Mobile App Access

- Integration with Accounting Software

- Compliance Management

- Employee Benefits Administration

Top 3 Features

- Automated Payroll Processing:

Automates the entire payroll process, reducing errors and saving time for payroll administrators.

- Tax Filing Services:

Handles federal, state, and local tax filings, ensuring compliance and reducing the risk of penalties.

- Employee Self-Service Portal:

Allows employees to access their pay stubs, tax documents, and personal information online, enhancing transparency and convenience.

Pros

- Ease of Use

- Comprehensive Support

- Scalability

Cons

- Cost

- Learning Curve

Pricing

Heartland Rippling offers a flexible pricing structure based on the number of employees and the specific services required. While exact pricing details are not publicly disclosed, businesses can request a customized quote to fit their needs. Generally, the cost includes a base fee plus a per-employee charge, with additional fees for advanced features and services.

Final Verdict

Heartland Rippling stands out as a powerful payroll solution that caters to the diverse needs of businesses. Its extensive feature set, combined with a user-friendly interface and robust support options, makes it a strong contender for those seeking an alternative to QuickBooks Payroll. While it may be on the pricier side, the investment is justified by the comprehensive functionality and reliability it offers. For businesses looking for a scalable, efficient, and compliant payroll solution, Heartland Rippling is a top choice.

Best of the Best

When it comes to payroll software, several options stand out as the best alternatives to QuickBooks Payroll. Here, we highlight the top three choices, with ZarMoney leading the pack as the ultimate solution.

1. ZarMoney

ZarMoney takes the top spot due to its unparalleled combination of functionality, ease of use, and affordability. ZarMoney offers an all-in-one solution that not only handles payroll with precision but also integrates seamlessly with other financial management tools, making it the most comprehensive choice for businesses.

2. Heartland Rippling

Heartland Rippling is a versatile payroll software known for its robust feature set and user-friendly interface. It offers comprehensive support and automation capabilities, making it a strong contender for businesses seeking efficiency and reliability in payroll processing.

3. Gusto

Gusto is another excellent alternative, offering an intuitive platform with a focus on user experience and comprehensive payroll features. Gusto stands out for its excellent customer service and affordability, making it ideal for small to mid-sized businesses.

Overall Conclusion

Choosing the right payroll software is crucial for ensuring smooth and accurate payroll processing. While QuickBooks Payroll is a popular choice, there are several excellent alternatives available that offer unique features and benefits. ZarMoney stands out as the top alternative, providing a comprehensive solution that integrates payroll with powerful accounting features. Heartland Rippling and Gusto also present strong options, each with their own strengths in automation, compliance, and ease of use. By carefully evaluating your business needs and comparing the features of these top contenders, you can select the payroll solution that best suits your organization.

FAQs

1. What is ZarMoney, and why is it the best alternative to QuickBooks Payroll?

ZarMoney is a comprehensive financial management software that integrates payroll with advanced accounting features. It is considered the best Quickbooks alternative due to its functionality, ease of use, and scalability.

2. How does Heartland Rippling handle tax filings?

Heartland Rippling automates federal, state, and local tax filings, ensuring compliance and reducing the risk of penalties.

3. What sets Gusto apart from other payroll software?

Gusto is known for its intuitive user interface, comprehensive benefits administration, and affordable pricing plans, making it ideal for small to mid-sized businesses.

4. Can I use ZarMoney for other financial tasks besides payroll?

Yes, ZarMoney offers an all-in-one solution that includes payroll, accounting, invoicing, and more, providing a unified platform for all financial management tasks.

5. Is Heartland Rippling suitable for large enterprises?

Yes, Heartland Rippling is scalable and suitable for businesses of all sizes, from small startups to large enterprises.

6. Does Gusto offer customer support?

Yes, Gusto provides excellent customer support, including live chat, phone support, and an extensive knowledge base.

7. What are the pricing options for ZarMoney?

ZarMoney offers flexible pricing based on the number of employees and specific services required. Businesses can request a customized quote to fit their needs.

8. Can employees access their payroll information with Heartland Rippling?

Yes, Heartland Rippling provides an employee self-service portal where employees can access their pay stubs, tax documents, and personal information online.

9. How easy is it to set up Gusto for payroll processing?

Gusto is known for its easy setup process, making it simple for users to get started with payroll processing quickly.

10. What makes ZarMoney the most comprehensive payroll solution?

ZarMoney integrates payroll with powerful accounting features, offers scalability for businesses of all sizes, and provides an intuitive user interface, making it the most comprehensive solution available.