Forex supply and demand trading is a popular strategy used by many traders to identify potential trading opportunities. It is a simple but powerful technique that involves analyzing the levels of supply and demand in the Forex market Continue Reading

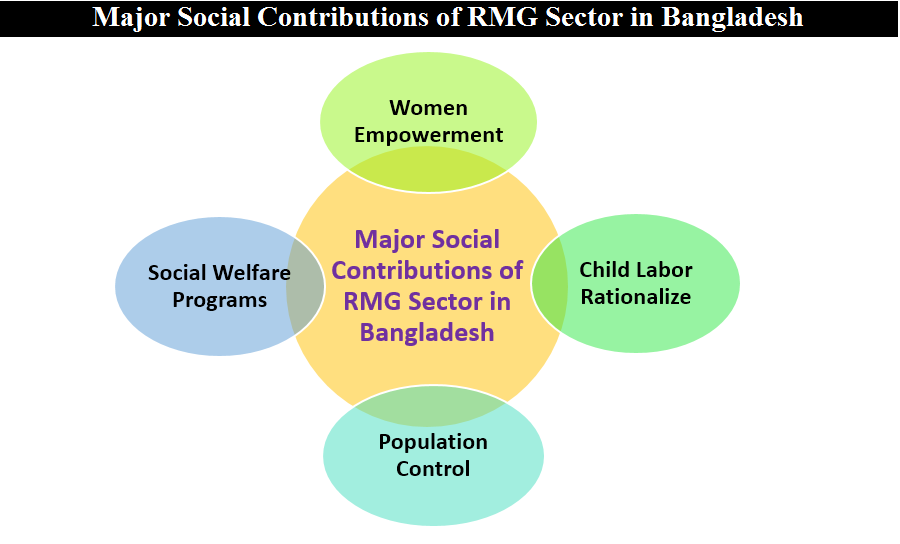

Major Social, Technological and Environmental Contributions of RMG Sector in Bangladesh

RMG sector is one of the important sectors which has so many contributions in the social, technological & environmental development of Bangladesh. In this article, some major social, technological & environmental contributions of the RMG sector are described. Continue Reading

Major Economic Contributions of RMG Sector in Bangladesh

RMG sector is one of the important sectors which has so many contributions to the economic development of Bangladesh. In this article, some major economic contribution of RMG sector is described. It will be helpful to know the Continue Reading

Ready Made Garments Export of Bangladesh

The condition of RMG Ready Made Garments Export of Bangladesh 2018 Bangladesh is now one of the developing countries in the world. Ready-Made Garments (RMG) has a huge contribution to the economic growth of this country. The current Continue Reading

Issues of Preparation and Implementation of ADP

Issues of Preparation and Implementation of ADP As per the poverty reduction strategy of the government of Bangladesh, the main issues of preparation and implementation of ADP (Annual Development Program) are accelerating economic growth, lowering inflation, generating employment, Continue Reading

Factors are Important for Efficient Decision Making

Why are the economic analysis and in-depth understanding of economic factors is important for effective decision making in the capital market? Investors always try to formulate the best possible portfolio by investing in the capital market for the Continue Reading