The allure of the finance industry stretches far beyond the trading floors of Wall Street. For those fascinated by the Continue Reading

How Can You Avoid Bankruptcy?

Filing bankruptcy is something that many people hope to avoid. It can have long-lasting effects on your credit score and Continue Reading

Setting Up Your LLC in Russia? Follow These 8 Tips for a Smooth Setup

Getting started with your company in a country like Russia can seem exciting and daunting at the same time. The Continue Reading

10 Finance Tips for Managing Your Invoicing

The growth or fall of any business is majorly anchored on its financial management. Irrespective of how great your business Continue Reading

What is Feasibility Study?

To answer the question of what is feasibility study, I would simply say that a feasibility study is the way Continue Reading

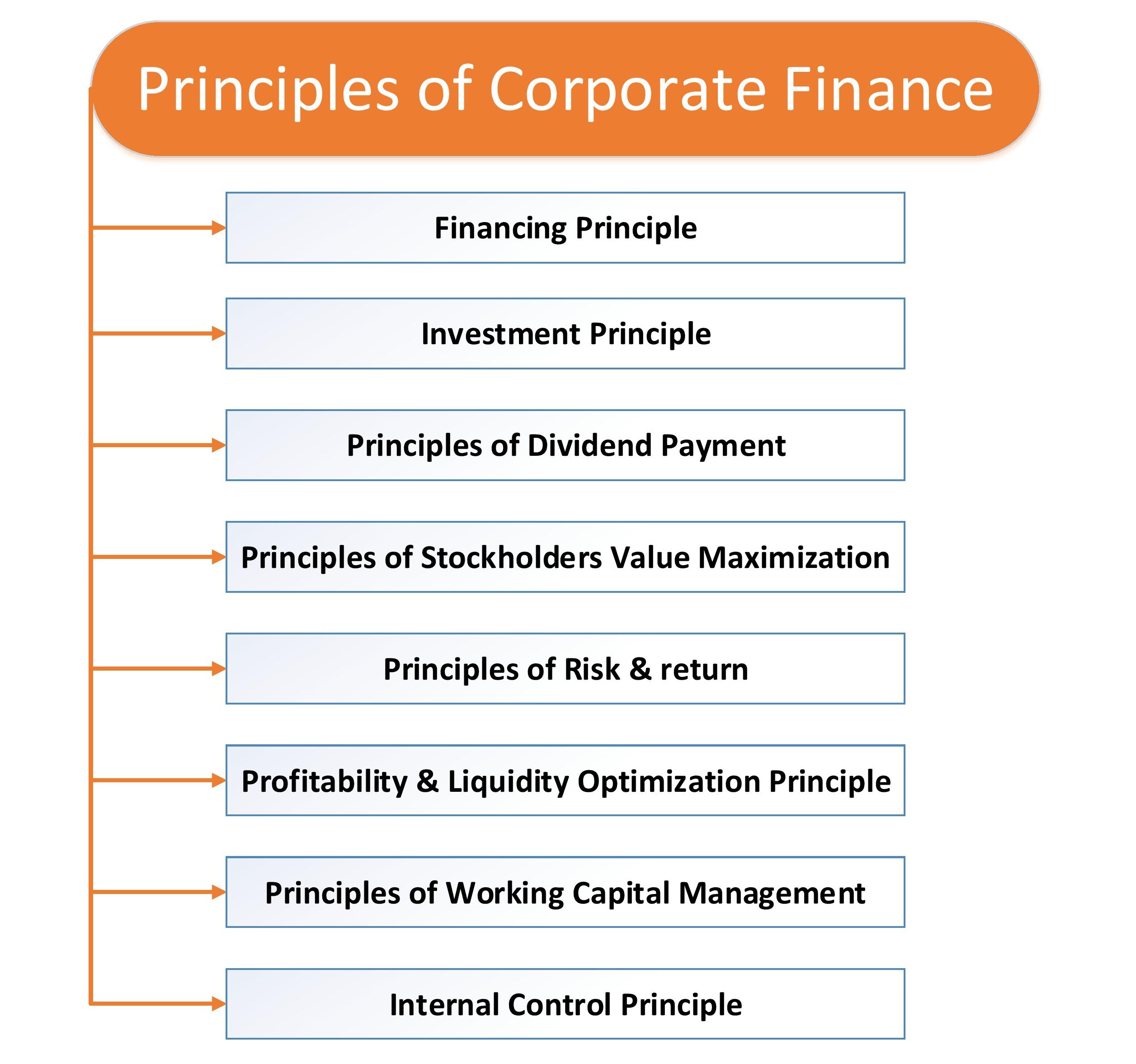

8 Must Know Corporate Finance Principles by a Successful Manager

The corporate finance principles work as a guideline for the corporate to ensure better application of finance. This helps to Continue Reading