The growth or fall of any business is majorly anchored on its financial management. Irrespective of how great your business Continue Reading

What is Feasibility Study?

To answer the question of what is feasibility study, I would simply say that a feasibility study is the way Continue Reading

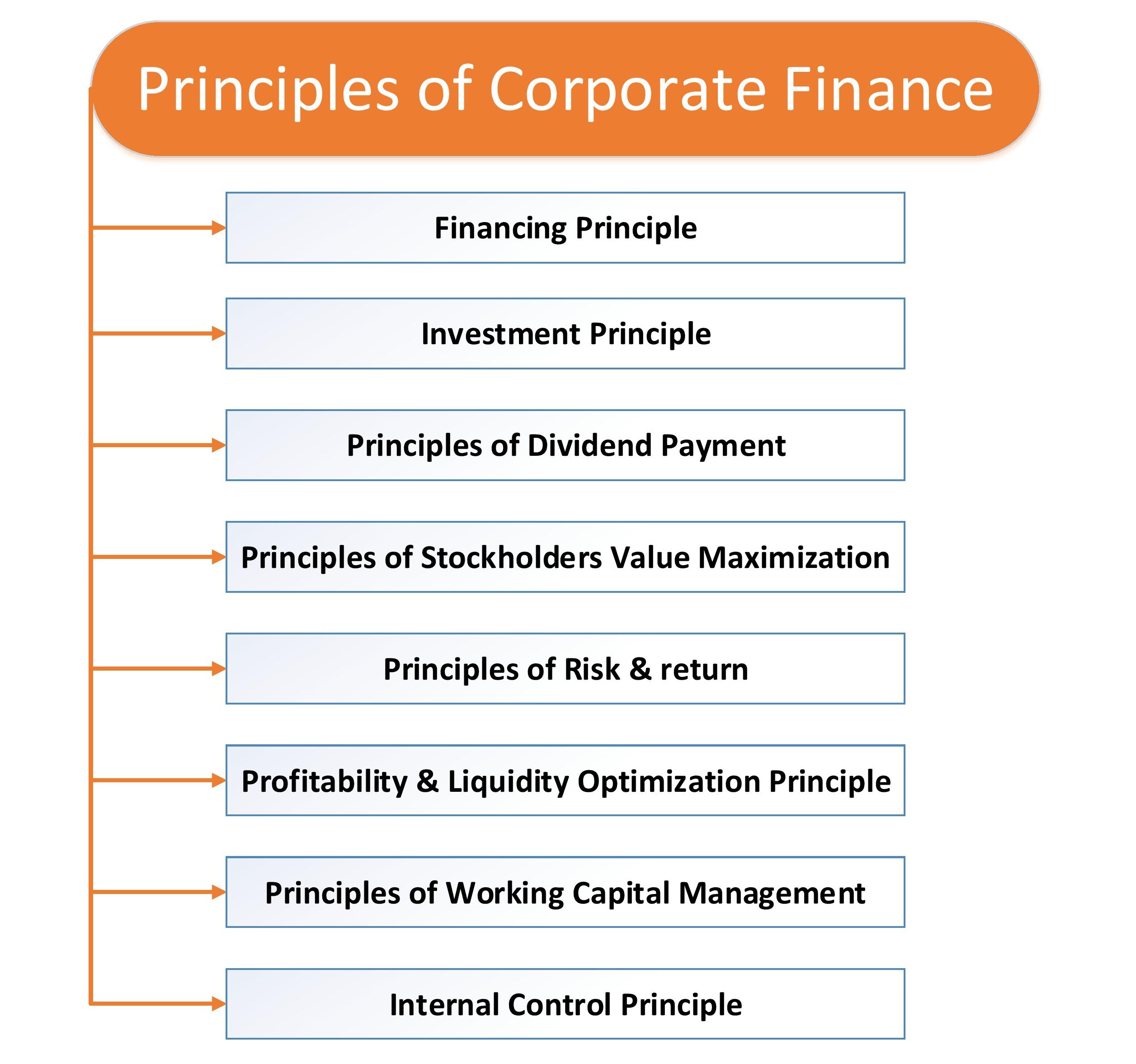

8 Must Know Corporate Finance Principles by a Successful Manager

The corporate finance principles work as a guideline for the corporate to ensure better application of finance. This helps to Continue Reading

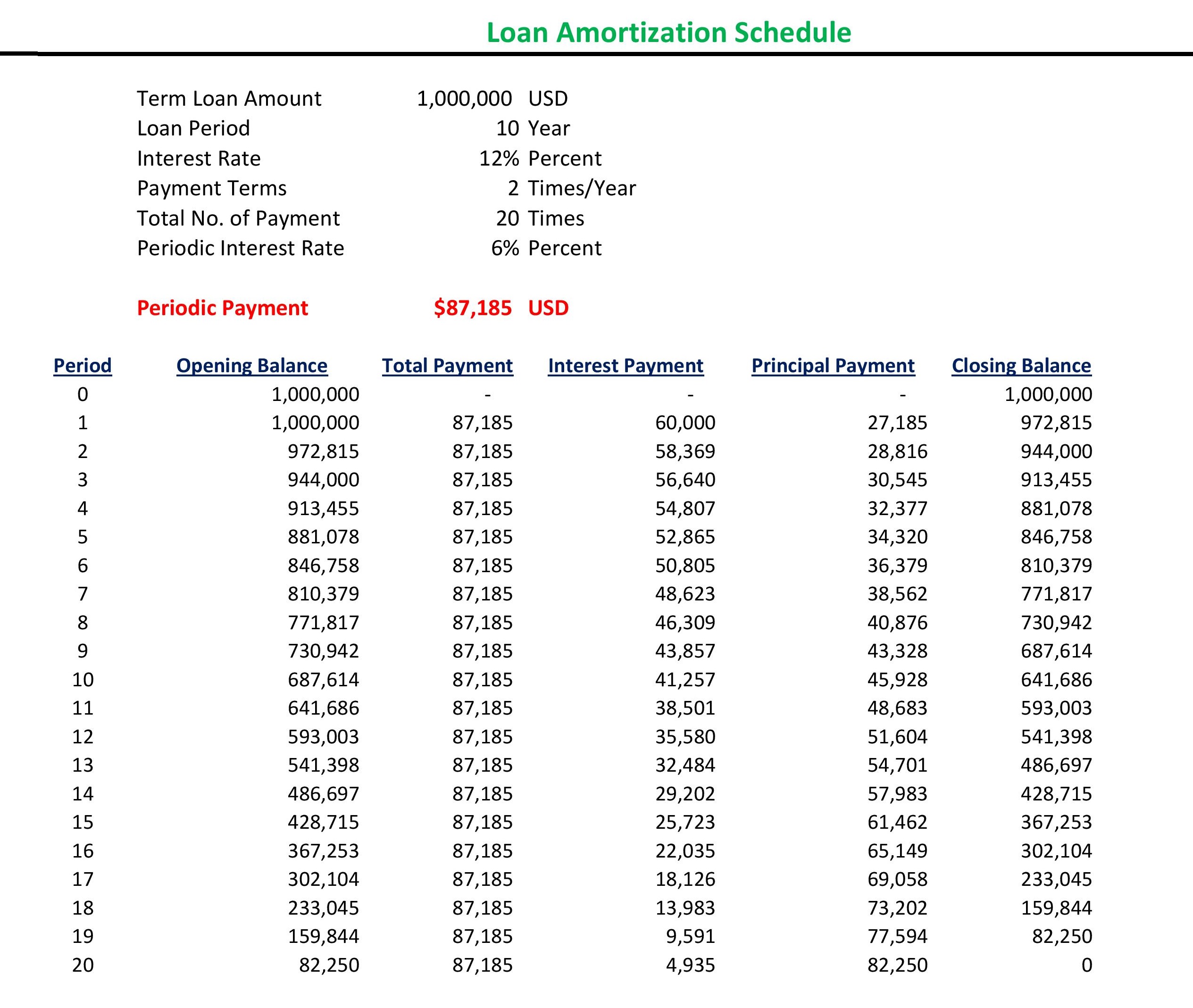

How to Make Loan Amortization Schedule in Excel

There is an inbuilt auto loan amortization schedule in Microsoft Excel accessible for free. You can use it any time Continue Reading

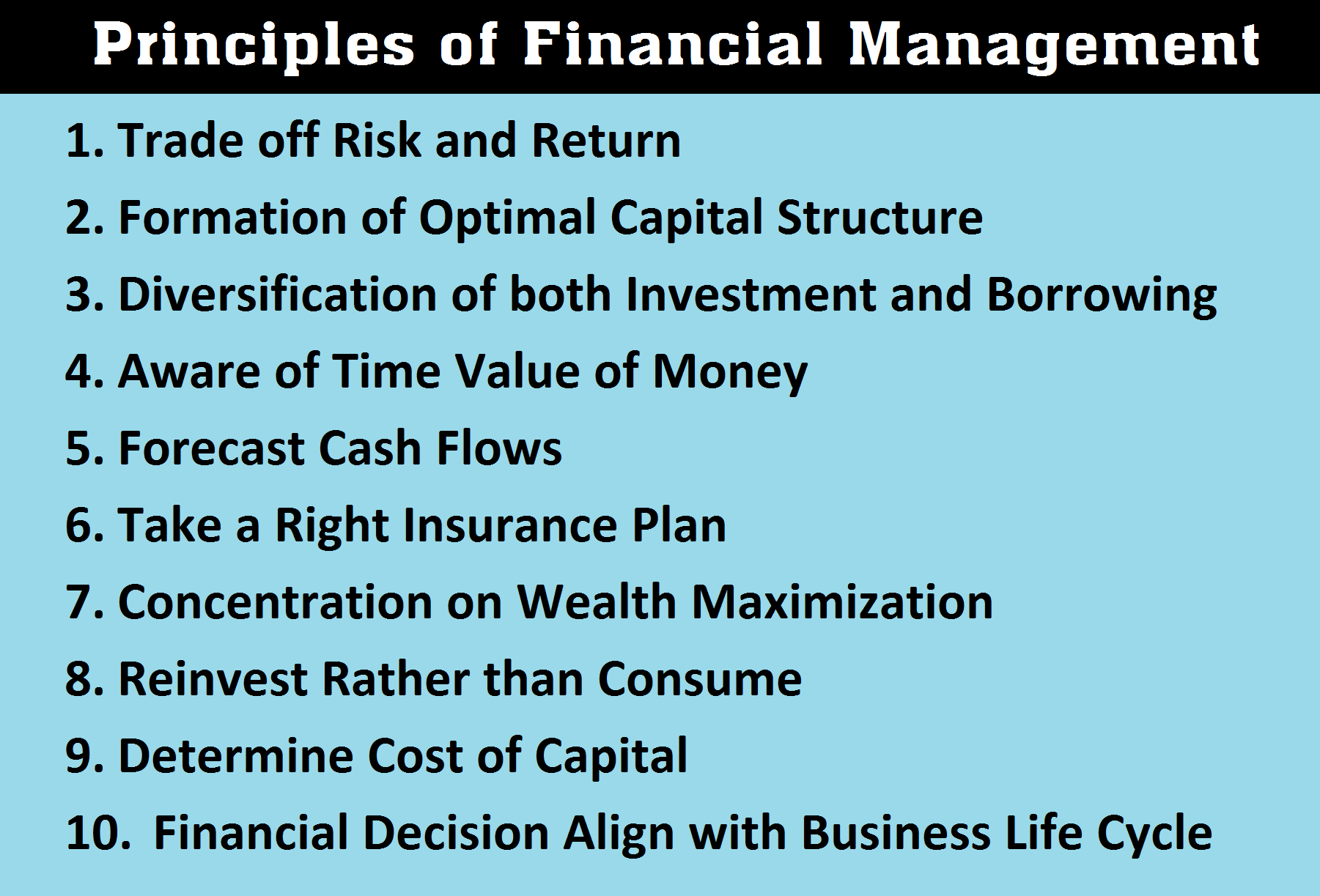

10 Principles of Financial Management

The principles of financial management work as a guideline for managing financial activities. If you properly understand and apply the Continue Reading

Finance Manager Job Description [Updated]

The core job responsibility of a finance manager is to manage the funds. Management of funds is not an easy Continue Reading

![Finance Manager Job Description [Updated]](https://ordnur.com/wp-content/uploads/2019/10/Finance-Manager-Job-Description.png)