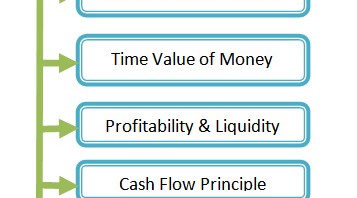

Financing involves gathering funds for strategic investment, ensuring their effective utilization. This process adheres to six core principles of finance, aimed at maximizing benefits. The individual overseeing these funds is Continue Reading

What is Knitted Fabric

What is Knitted Fabric? Knitted Fabric: Knitted fabrics provide comfortable wear to almost any garment. For making comfortable wear we first think about knitted garments. Though it has an open structure, Continue Reading

What is Finance

What is Finance? Finance is all about taking decisions of financial resources i.e. how money or funds will receive and ensure the right use of resources for maximizing financial benefit. Continue Reading