First of all, let’s have some discussion about capital budgeting so that you can understand what capital budgeting is and why there is the importance of capital budgeting for financial Continue Reading

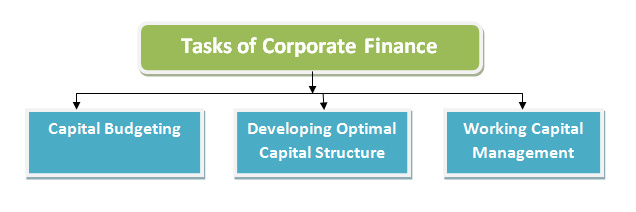

Tasks of Corporate Finance

Corporate finance is a branch of finance where financing decisions about choosing a least-cost source of funds and optimal capital structure. The main tasks of corporate finance are to ensure Continue Reading